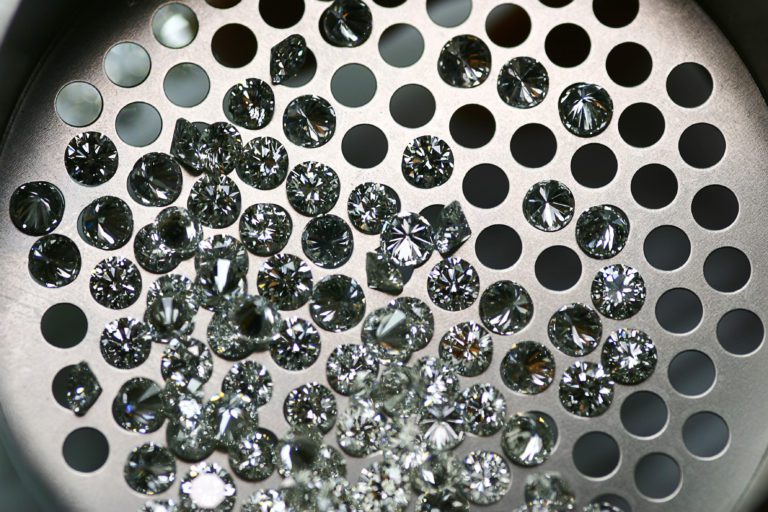

In the ever-evolving landscape of the jewelry industry, lab-created diamonds have emerged as a shining star, captivating the attention of consumers and reshaping market trends. R&J Jewelry and Loan have an inventory of diamonds, including lab created diamonds.

Lab diamonds ethical appeal, eco-conscious production, and impressive aesthetics, have witnessed a surge in popularity that reflects evolving consumer preferences.

Rising Stars: Lab-Created Diamonds’ Meteoric Ascent

The jewelry market has experienced a paradigm shift with the rise of lab-created diamonds. These gems, cultivated in controlled laboratory environments, have rapidly gained traction among consumers seeking an ethically conscious and sustainable alternative to traditional natural diamonds.

The growth trajectory of lab-created diamonds is nothing short of meteoric, as they challenge conventional norms and carve out a unique niche in the jewelry industry.

When it comes to looking for a pawn shop with both natural diamonds and lab created diamonds, R & J Jewelry stands out in the area by offering a fair and honest appraisal for their customers.

They pay top dollar for 1-carat diamonds and larger and pay premium prices for GIA and EGL certified stones.

They have a GIA trained gemologist with many years of experience who can look at your diamond and assess its value. When you’re looking to sell jewelry, they can instantly exchange your jewelry and get you cash on the spot.

Ethical Allure and Environmental Responsibility

One of the key driving forces behind the ascent of lab-created diamonds is the ethical allure they offer. Unlike their natural counterparts, lab-created diamonds bypass the issues associated with traditional diamond mining, such as potential human rights violations and environmental degradation. Consumers are increasingly drawn to the idea that their jewelry choices can align with their values of social responsibility and environmental preservation.

Where are Most of the Lab Created Diamonds Made?

The majority of lab-created diamonds were being produced in countries such as the United States, China, India, and Russia. These countries have been leading the way in developing the technology and infrastructure necessary for creating synthetic diamonds through various methods, including High Pressure High Temperature (HPHT) and Chemical Vapor Deposition (CVD) processes.

With a substantial manufacturing contribution of 56 percent, China holds a prominent position as the leading manufacturer of lab-grown diamonds reported in 2022. Following closely, India and the United States emerge as the second and third largest producers, representing shares of 15 percent and 13 percent respectively.

A Glittering Choice for Modern Consumers

Consumer preferences are evolving, and lab-created diamonds are perfectly poised to cater to these changes. Today’s consumers are well-informed, socially conscious, and place a high value on products that align with their beliefs. Lab-created diamonds resonate with this demographic due to their conflict-free origin and reduced carbon footprint. This has prompted a significant shift in consumer sentiment, with more individuals opting for lab-created diamonds as a symbol of their commitment to a better world.

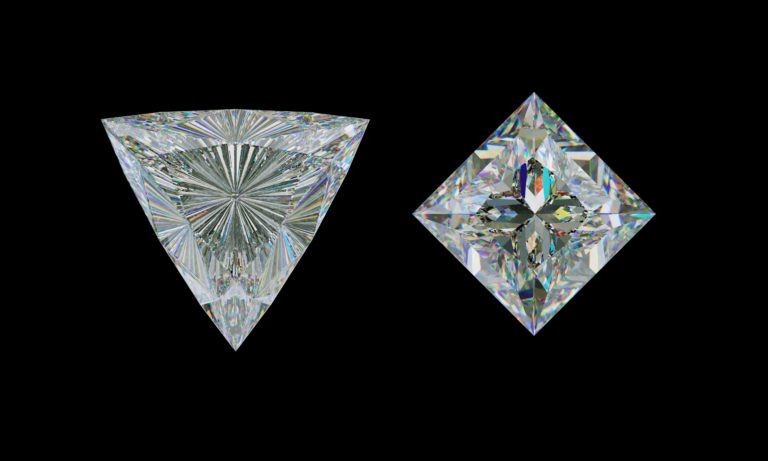

Innovative Appeal and Customization

The jewelry industry has witnessed a wave of innovation propelled by lab-created diamonds. These gems can be crafted with exceptional precision, allowing stunning cuts and designs that may not be achievable with their natural counterparts. This level of control and precision has enabled jewelers to create truly unique and customizable pieces that cater to the diverse tastes and preferences of modern consumers.

One of the interesting and unusual cuts that gained attention was the “Trillion” or “Trilliant” cut. This cut features a triangular shape with curved sides, often used for accent stones in jewelry or as a centerpiece.

Mainstream Acceptance and Market Trends

Lab-created diamonds have transcended their initial status as an alternative and have firmly established themselves within the mainstream jewelry market. Market trends indicate a growing acceptance and demand for lab-created diamonds, with prominent jewelry brands incorporating them into their collections. This shift is indicative of a broader movement towards more sustainable and ethical consumer choices, where lab-created diamonds hold a significant place.

Balancing Tradition with Progress

While lab-created diamonds are gaining momentum, it’s important to note that consumer preferences are diverse and nuanced. Traditionalists who value the rarity and mystique of natural diamonds continue to exist within the market. However, what’s evident is that lab-created diamonds are providing a bridge between tradition and progress. They offer a way for consumers to celebrate life’s milestones with beautiful and ethically sourced gems while contributing to a positive impact on the planet.

Who in the US are lab created diamond jewelers?

The field of lab created diamond jewelers changes quickly. Here are a few well known lab created diamond jewelers.

Brilliant Earth: Brilliant Earth is well-known for its commitment to ethically sourced and sustainable jewelry. They offer a range of lab-created diamond options for engagement rings, wedding bands, and other jewelry pieces.

James Allen: James Allen is a reputable online jeweler that offers a wide selection of lab-created diamonds. They allow customers to customize their engagement rings and other jewelry pieces by choosing a lab-created diamond and pairing it with various settings.

Clean Origin: Clean Origin specializes in lab-created diamonds and offers various options for engagement rings and fine jewelry. They focus on transparency and provide high-quality, eco-friendly diamonds.

Ada Diamonds: Ada Diamonds is known for its lab-grown diamond jewelry, with an emphasis on unique designs and customization. They cater to customers seeking distinctive and personalized pieces.

Miadonna: Miadonna offers lab-grown diamonds and lab-grown gemstones, emphasizing ethical and sustainable practices. They have a range of engagement rings, wedding bands, and other jewelry options.

The True Gem: The True Gem offers lab-grown diamonds alongside natural diamonds, giving customers the choice to select the type of diamond they prefer. They offer customization and unique designs.

Forever One by Charles & Colvard: Charles & Colvard is renowned for its moissanite gems, but they also offer a line of lab-created diamond jewelry under the “Forever One” brand.

MiaDonna & Company: MiaDonna & Company offers lab-created diamonds and supports charitable causes through their business model. They provide a selection of lab-created diamond engagement rings, wedding bands, and more.

- R&J Jewelry & Loan located in San Jose, CA offers pre-owned lab created diamonds and natural diamonds. With a GIA trained gemologist on the team, the pawnshop can offer a range of pre-owned engagement rings, wedding bands and other jewelry options.

A Dazzling Future

The jewelry industry is experiencing a transformative period, and lab-created diamonds are at the forefront of this evolution. As consumer preferences shift towards sustainability, ethics, and innovation, the popularity of lab-created diamonds continues to rise. These diamonds not only offer a responsible choice, but also embrace the values and aspirations of modern consumers.

With their dazzling allure and eco-conscious foundation, lab-created diamonds are poised to shape the future of the jewelry industry, inspiring a new generation of glittering memories.

In a world where conscious consumerism is gaining traction, lab-created diamonds offer a glimmer of hope and promise of beauty without compromise. As the market trends continue to shift and consumer preferences evolve, lab-created diamonds will likely continue to shine brightly, illuminating the path toward a more responsible and enchanting jewelry landscape.

R&J Jewelry and Loan in San Jose, CA will continue to provide high quality natural and lab created diamonds. As a trusted pawnshop in the industry, you can rest assured when you shop with R&J Jewelry, you get quality. Visit them today.