Looking into gold chains? This guide covers the best styles like Miami Cuban links, explores the benefits of solid gold, and provides tips on choosing and maintaining your chain. Dive in to find the perfect gold chain for you.

Key Takeaways

-

Miami Cuban link chains are not just a fashion statement, but also success and wealth, with a history rooted in hip-hop culture.

-

Solid gold chains, especially 14k gold, are durable, beautiful, and a smart investment, making them suitable for everyday wear.

-

Buying pre-owned gold chains is budget-friendly and eco-conscious, plus R&J Jewelry and Loan offers a respected selection and appraisal process.

The Allure of Miami Cuban Link Chains

The Miami Cuban link chains have become a hallmark within the jewelry landscape, renowned for their unique arrangement of interlocked oval links, which produce an attractive flat and textured look. These particular chains are notable for their rope-like pattern, compared to traditional flat link chains typically soldered together, enabling them to move smoothly.

Initially rising to fame amidst the hip-hop scene of the 1970s and 80s predominantly around New York City, these Miami Cuban styles were embraced by artists who played a significant role in popularizing this distinct aesthetic. As time has passed, there’s been a transition from more refined versions to heavier and bolder incarnations reflecting shifts in hip-hop culture itself. The cultural importance of such pieces is profound, as they embody both ambition and success within urban life narratives.

These luxurious items extend beyond mere decorative accessories. They’re powerful emblems, signifying opulence and status frequently sported by influential personalities across music and sports arenas, enhancing their glamorous reputation. For those seeking either audacious self-expression or simply an admiration for exquisite craftsmanship, Miami Cuban link chains retain an enduring allure throughout changing times.

Why Choose Solid Gold Chains?

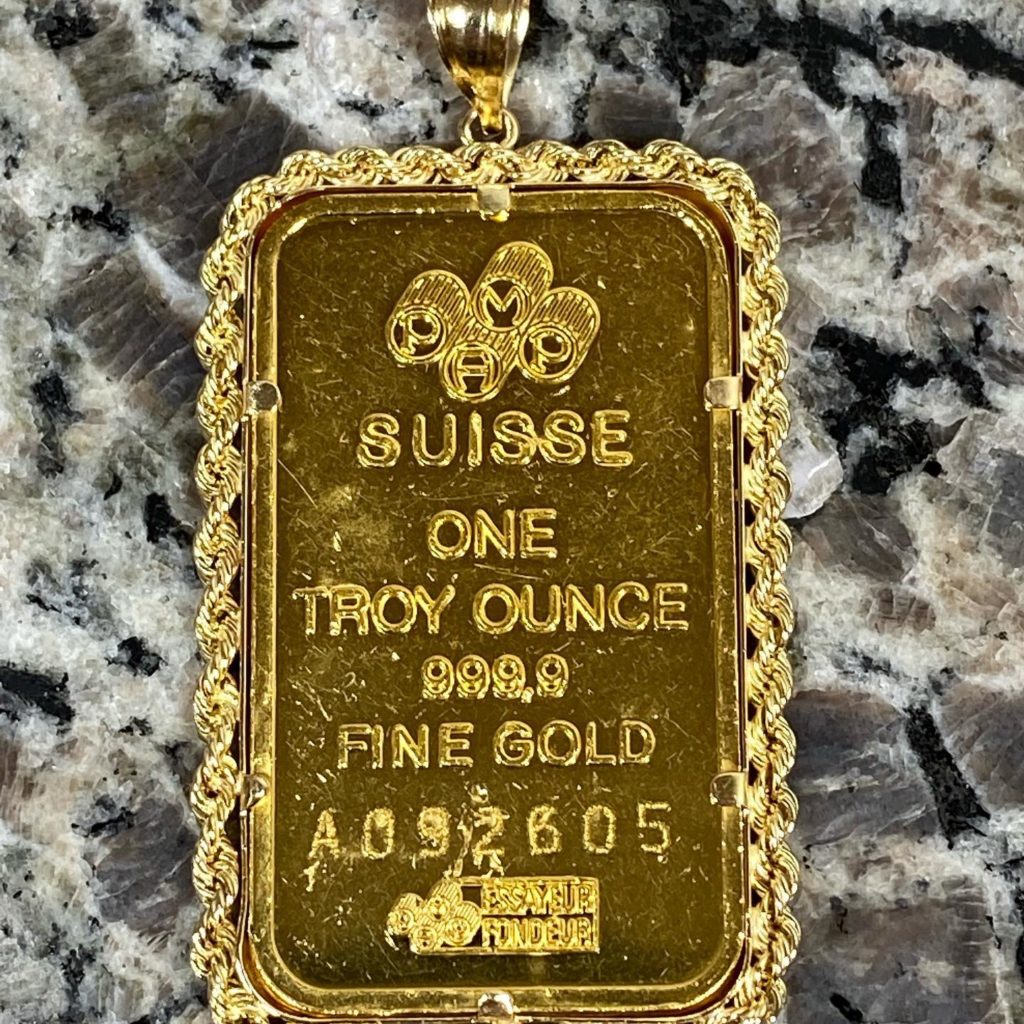

Solid gold chains are renowned for their outstanding durability, which is one of their key advantages. These chains do not succumb to tarnishing or corrosion over time, ensuring they maintain the same luster as when they were initially adorned. The enduring nature of solid gold also allows these pieces to be passed down as heirlooms within families, preserving both their beauty and monetary value.

The allure of solid gold cannot be overstated—its opulent appearance and perpetual sheen set it apart from lesser plated options. Chains crafted from pure solid gold are emblematic of luxury due to the complete use of this valuable material in their composition. Such jewelry doesn’t just dazzle. It reflects a high socioeconomic status and affluence.

14K gold enjoys widespread popularity because it provides an optimal blend between rich coloration, long-lasting durability, and affordability. It serves as a cost-effective alternative compared to higher karatage like 18K or 22K, while still maintaining commendable quality standards. Opting for solid gold means investing in an item that embodies elegance with resilience at appreciable value points.

Exploring 14k Solid Gold Options

As a preferred option among gold jewelry enthusiasts, 14k solid gold stands out. Solid gold pieces are pure gold mixed with alloys for increased strength. The resulting composition ensures that items made from 14k solid can endure the rigors of daily usage without succumbing to scratches, making them perfect for frequent wear and an affordable choice.

In terms of resilience, 14k falls between softer higher karats like 18K and more robust alternatives. It strikes an optimal balance by offering sustained sturdiness and aesthetic appeal, which makes it ideal for individuals with dynamic lifestyles who don’t want to compromise on elegance.

The alloy mix in 14k paves the way for delightful variations, such as rose and white varieties of solid. By incorporating metals like copper or nickel alongside standard yellow versions, jewelers can offer an exquisite range that caters to diverse tastes—from those enamored by rose hues’ warmth to others inclined towards white sleekness—ensuring there is a piece of fine-looking yet enduring jewelry crafted from versatile options within the realm of tasteful preferences offered by this type’s magnificence.

The Perfect Length for Your Chain

The appropriate length of your Miami Cuban chain can dramatically alter the aesthetic you present. The range for standard necklace lengths typically extends from 14 to 36 inches, with each length suited for distinct styles and settings. Choker-style necklaces that span between 14 and 16 inches closely embrace the neck and highlight the neckline. A piece measuring about an inch longer at 18 inches is commonly known as a princess-length necklace. It sits slightly below the throat, which allows it to complement various clothing options.

Necklaces around twenty inches in length dangle just past the collarbone, making them suitable choices for both relaxed and more sophisticated outfits. When deciding on an ideal length, consider your body shape, as well as what kind of neckline you’ll be sporting. To determine which size would provide the optimal fit, use a pliable tape measure carefully against your neck area. Selecting an apropos Miami Cuban link could accentuate not only your neckline, but also draw favorable attention toward facial features.

To craft a fashionable ensemble through jewelry pieces involves layering chains differing in their lengths – this could include combinations like chokers with princess or matinee-sized links, resulting in varied depths within one’s attire that enhances personal style expression remarkably. Opting either for emphasizing sole statement accessories or adopting multiple layers enables distinctive looks, where choosing precise chain lengths holds substantial importance.

Customizing Your Cuban Link Chain

The allure of Miami Cuban link chains lies in the extensive personalization possibilities they offer. A variety of styles, such as the classic Miami look, iced-out designs, and prong settings, are available to cater to individual preferences. You have the freedom to choose from different gold hues, incorporate diamond embellishments or engrave custom messages for a truly distinctive creation.

Adding diamonds or other precious gems can elevate your Cuban link chain with an additional touch of elegance and personality. Depending on whether you desire understated sophistication or eye-catching glamour, these stones can transform your piece into something unique. The type of clasp selected is another aspect that allows customization. Choices like lobster clasps or box clasps not only influence aesthetics, but also functionality.

At R&J Jewelry and Loan, you’re given even more options for tailoring your chain exactly how you want it, by picking specific lengths and grades of gold purity. Their dedicated customer service team is ready to guide you through selecting features that reflect your taste perfectly—crafting a one-of-a-kind Miami Cuban link chain that showcases your distinct flair and ensures distinction within any gathering.

R&J Jewelry and Loan’s Exclusive Collection

At R&J Jewelry and Loan, an exquisite assortment of pre-loved gold chains awaits those seeking luxurious accessories at accessible prices. The carefully curated collection features both timeless vintage pieces and sleek modern styles to satisfy various tastes.

The extensive selection provided by R&J Jewelry and Loan has significantly lower prices than standard retail offerings. By choosing from their array of gold chains, customers can indulge in opulence without compromising their finances. Renowned for blending quality with cost-effectiveness, R&J Jewelry and Loan is the premier choice for anyone looking to acquire splendid gold jewelry.

How to Order Your Miami Cuban Link Chain

Securing a Miami Cuban link chain from R&J Jewelry and Loan is an effortless endeavor. Initiate your search by exploring their diverse assortment on the website or by visiting them in-store. Once you have selected the ideal Miami Cuban, you can confidently complete your purchase online via their encrypted checkout system, which guarantees the safety of your personal details and the swift handling of your order.

After finalizing your transaction for a magnificent gold link chain, expect to receive an email confirmation that includes all pertinent information regarding your purchase, along with anticipated delivery timings, ensuring you are well-informed throughout the process. Whether purchasing for personal enjoyment or as a special present, R&J Jewelry and Loan streamlines obtaining this exquisite piece of jewelry.

The Art of Appraisal at R&J Jewelry and Loan

At R&J Jewelry and Loan, clients are assured a clear and fair appraisal process when valuing their items. The seasoned associates at the establishment perform comprehensive assessments to ensure that customers are offered an honest and just price for their possessions. This dedication to integrity and openness fosters confidence among their client base.

Experts scrupulously evaluate the pre-owned merchandise available at R&J Jewelry and Loan to affirm its quality and genuineness. Through this detailed evaluation procedure, customers can be certain they’re acquiring authentic jewelry that complies with stringent standards of excellence. Whether engaging in purchase or sale transactions, you can depend on the accuracy of appraisals provided by R&J Jewelry and Loan, reflecting true market value assessments.

Benefits of Pre-Owned Gold Chains

Opting for second-hand gold chains presents numerous advantages, which appeal to a wide range of consumers. One key benefit is the considerable cost savings compared to new retail prices. These pre-owned pieces offer all the elegance and prestige associated with brand-new items, but come at a much lower price point, making them an ideal selection for those mindful of their finances.

Choosing second-hand gold chains supports environmental conservation efforts. Solid gold can be repurposed through recycling – it can be melted and refashioned into new items, diminishing the need for fresh mining endeavors and manufacturing activities. This eco-friendly choice allows individuals to indulge in exquisite jewelry without compromising ecological responsibility.

Conclusively, acquiring pre-owned gold chains from R&J Jewelry and Loan carries both economic benefits and environmental considerations. Their substantial collection ensures that patrons will find exactly what they’re searching for—a perfect piece that harmoniously fits within one’s financial plan, while also upholding sustainable values.

Tips for Maintaining Your Gold Chain

Preserving the beauty and longevity of your gold chain involves proper maintenance. Gold, being a malleable metal, is prone to scratches and dents. Removing your jewelry during physical activities can help prevent damage. Chlorine can significantly weaken gold jewelry, so it’s best to remove your chain before swimming or using hot tubs.

Household cleaners with acids or abrasives can harm gold jewelry. Wearing gloves or removing jewelry while cleaning is recommended. Proper storage is also crucial. Store gold chains separately in a fabric-lined jewelry box to prevent tangling and scratches. Following these tips can help your gold chain remain in pristine condition for years to come.

The craftsmanship of Cuban link chains involves careful soldering techniques that ensure durability and a polished finish. Regular cleaning and proper care will maintain the chain’s shine and structural integrity, allowing you to enjoy your piece for a lifetime.

Summary

Miami Cuban link chains are renowned for their distinct cultural significance, robustness, and fashionable appeal. Opting for a chain made of solid gold, particularly 14k gold, is an investment in an item that marries aesthetic allure with functionality. Selecting the ideal length and exploring personalization opportunities enable you to acquire a Miami Cuban link chain that accurately represents your individual style.

For those interested in acquiring either new or previously owned Miami Cuban gold chains, R&J Jewelry and Loan offers various choices tailored to meet individual tastes and financial considerations. Their dedication to high-quality service, coupled with a clear valuation process and focus on eco-friendly practices, establishes them as trustworthy purveyors. By adhering to suggested care guidelines for your Miami Cuban link chain, its status as a valued possession can be preserved well into the future.

Frequently Asked Questions

Why are Miami Cuban link chains so popular?

Miami Cuban link chains are super popular because of their unique design and strong ties to hip-hop culture, making them a status symbol of success and wealth.

They stand out and have become a must-have for many!

What makes solid gold chains a good investment?

Solid gold chains are a smart investment because they’re durable, resist tarnishing, and can hold their value well, often turning into treasured heirlooms.

You can’t go wrong with something that lasts!

Why is 14k solid gold a popular choice for jewelry?

14k solid gold is super popular because it balances durability, beautiful color, and affordability, making it perfect for everyday jewelry without breaking the bank.

How can I determine the perfect length for my gold chain?

To find the perfect length for your gold chain, measure your neck with a flexible tape and consider your body type and neckline.

This will help you choose a length that enhances your look!

What are the benefits of purchasing pre-owned gold chains?

Buying pre-owned gold chains can save you a ton of cash and helps the planet by cutting down on new mining.

It’s a win-win for your wallet and the environment!