Bullion is a non-ferrous metal. Non-Ferrous metals are alloys or metals that do not contain iron. All pure metals are considered non-ferrous. Bullion is refined to a high standard of purity. It is used in the production of coins and gold and silver bars. Bullion can also include platinum and other derivatives.

Bullion is bought and sold worldwide, but the London Bullion Market is known as the primary global market trading platform for gold and silver.

The Integrity Standards for Gold Bullion

The London Bullion Market Association operates as an international trade association. It coordinates activities of its members in the London bullion market and sets and promotes quality stands for gold and silver bullion bars. According to the London Bullion Market Association, the acceptable fineness of the Good Delivery Bars is 99.9% for gold and 99.9% for silver bars. The Good Delivery specification is a set of rules issued by the London Bullion Market Association.

The World Gold Council is a market development organization for the gold industry. It is involved across all parts of the gold industry, from mining to investment. Its purpose is to stimulate and sustain demand for gold. The World Gold Council and the London Bullion Market Association are working together to develop and implement an international system of gold bar integrity.

Investment Portfolios

Investment portfolios are a collection of financial investments like stocks, bonds, commodities, cash, gold, and silver acquired to obtain an additional source of income or gain profit over time. Congress authorized United States Mint Bullion Coins to provide investors with a convenient and cost-effective way to add physical gold, silver, platinum, and palladium to their investment portfolios.

American Eagle Bullion Coins

In 1986 the American Eagle Bullion Coin Program was launched and started selling American Eagle Gold and Silver Bullion Coins. in 1997, Platinum was added, and by 1917, palladium was added.

American Buffalo Bullion Coins

By 2006 under Pubic Law 109-145, the “Presidential $1 Coin Act of 2005,” the American Buffalo Bullion Coin was released and is one of the purest gold coins available, with a purity of 24k gold. The act established the guidelines for the coin’s design, production volume, price, legal tender status, gold sourcing, and more.

The Act says that James Earle Fraser’s designs for the ‘Buffalo Nickel’ will be used on the obverse and reverse sides of the $50 coin. All the gold needs to be sourced from the U.S. or in a U.S. territory within a year following the month the ore was mined in. It designates the coin as legal tender and specifies the coins as “numismatic items.”

"Numismatic Value"

Numismatic value is what a coin or coins are worth to a collector. The numismatic value is different from than melt value which is the value of the metals that the coins contain. When valuing coins, they have a value due to their collectibility and the value of the metal they are made from.

Gold Prices, Silver Prices, Bullion Prices

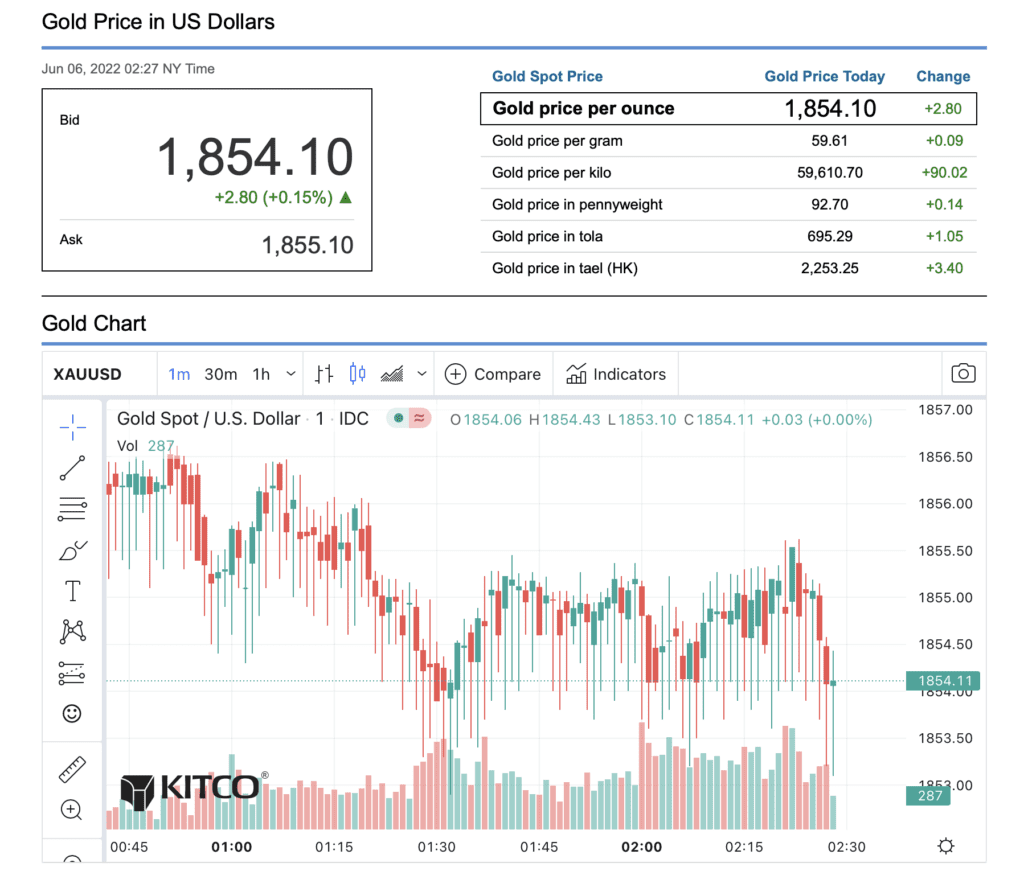

The price of precious metals is affected by supply and demand, the rate of return for the recipient of the metal, the spot price, and the likely cost of storing and transporting the precious metal. The spot price is the price per gram paid at any time. The spot price of gold or other metals is real-time prices.

The spot price fluctuates daily and throughout the day. Suppose there is an increased demand and low supply, and the price increases. Gold price and other metals pricing also are dependent on future contracts. Inflation, the economy, world events, and supply and demand contribute to the increase and decrease in the price.

Bullion is valued by the value of the precious metal its made of. The most common forms of bullion are bars and ingots, and coins. Bullion comes in gold, silver, and other metals, and gold bars are easily added to investment portfolios for a balanced portfolio.

Bullion and bars are also easy to store and don’t take up much room.

Troy Ounce

The system of a unit of mass primarily used to value and weigh precious metals originated in England during the 15th century using the weight units grain, pennyweight, troy ounces, and the troy pound.

Troy weight was made official for silver and gold in 1527. However, in 1824, the British Imperial systems of weights and measures were established and adopted into the United States as the official weight standard for U.S. coinage by the Act of Congress in May 1828.

The only modern and widespread use of the troy ounce is the British Imperial troy ounces and its American counterpart. In other countries where the International System of Units is mainly used, troy ounces are still used in precious metal markets. A troy ounce is mostly how physical bullion is measured today.

When someone wants to buy or sell gold, the gold is weighed, and the weight is calculated in troy ounces. The market value price of gold or other metals is used to determine the value after the purity of the precious metals is determined.

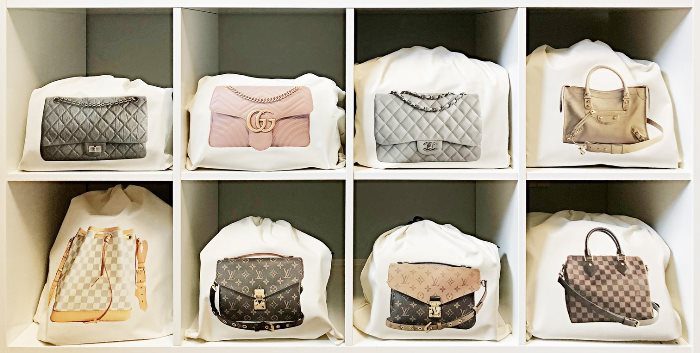

Pawn Shops will buy, sell, and use gold, silver, gold bullion, silver bullion, gold coins, gold jewelry, and other precious metals to secure short-term loans.

R & J Jewelry and Loan

R & J Jewelry and Loan, located in San Jose, CA, is in the business of providing full-service pawn services. The shop offers a full range of pawn shop services, and an investor can find the precious metals they are seeking for a balanced portfolio to set up as a hedge against inflation.

The family-operated store has continually built a reputation for personalized services and an extensive inventory of gold, silver, bullion, and luxury items. Since 1978 expert pawnbrokers have offered real money for high-end personal items, and fair and reasonable offers are how they do business.

For more information, visit: https://www.randjjewelry.com/