Introduction: What Is a Pawn Loan and Why San Jose Residents Use It

A pawn loan is one of the simplest ways to borrow money when you need fast cash without the hassle of credit checks, income verification, or lengthy approval processes. Here’s how it works: you bring in a valuable item—like gold jewelry, a diamond ring, or a luxury watch—and the pawn shop holds it as collateral while giving you a cash loan. When you repay the loan plus fees by the due date, you get your item back. If you can’t repay, the shop simply keeps the item and sells it. There are no debt collectors calling, no hit to your credit score, and no further obligations.

R & J Jewelry & Loan has been serving San Jose, CA, and surrounding communities since 1983 as a family-owned, licensed pawn shop and fine jewelry store. For over four decades, we’ve helped local residents navigate unexpected expenses, bridge gaps between paychecks, and access their emergency fund without selling cherished possessions outright. Our focus on luxury items—fine jewelry, diamonds, gold, silver, and designer handbags—means we understand the true value of what you bring in.

If you’ve ever wondered whether a pawn shop could be a safe, discreet, and professional option for short term loans, you’re in the right place. This article will walk you through exactly how pawnshop loans work at our San Jose location, what items we accept, what costs to expect, and why thousands of Bay Area residents have trusted us with their valuable items over the years.

How a Pawn Loan Works at R & J Jewelry & Loan

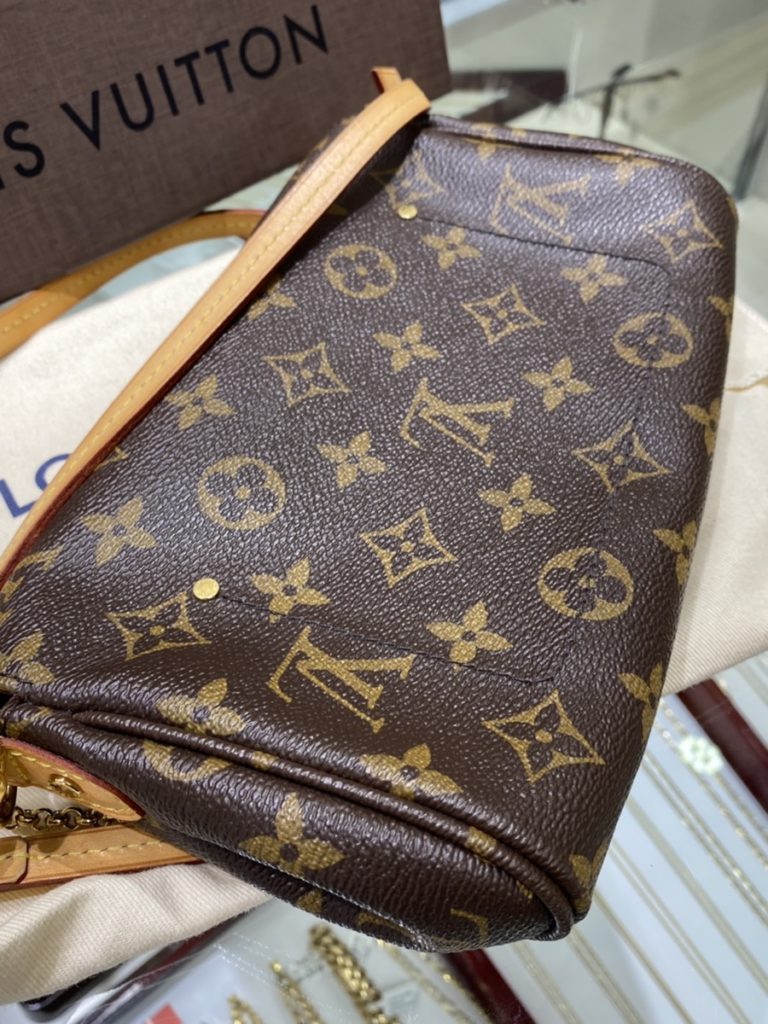

Understanding how pawnshop loans work is straightforward once you see the basic mechanics. When you visit our San Jose store, you bring in an item of value—say, a Rolex Submariner, a 14K gold chain, or a Louis Vuitton handbag. Our on-site specialists evaluate the item’s condition, authenticity, and resale potential to determine its current market value. The loan amount we offer is calculated as a percentage of the item’s resale value—typically between 25% and 60%—with the item’s resale being the key factor in how much you can borrow. The average pawn loan amount is usually between $75 and $100, which is often only 25% to 60% of the item’s resale value.

Once you accept the offer, we securely store your item and hand you cash along with a pawn ticket. This ticket is your receipt and contract rolled into one—it details the loan amount, the interest rates, any storage fees, the total payoff amount, and your due date. In California, pawn shop loan terms are regulated by state law, and our standard contract runs for four months. You have that entire period, plus a 10-day grace period, to repay the loan and reclaim your item.

The beauty of this arrangement is that your credit history, employment status, and income don’t factor into the equation. The loan is secured entirely by the collateral you provide. If circumstances prevent you from repaying, there are no collection calls, no lawsuits, and no damage to your credit. The shop simply retains ownership of the item and may sell it to recover the loan value. This non-recourse structure makes pawn loans one of the lowest-risk borrowing options for consumers who need cash quickly.

For example, if you pawn a luxury watch valued at $5,000 on the resale market, you might receive a loan between $1,250 and $3,000 depending on the specific model, condition, and demand. That money is yours to use however you need—whether for a car repair, medical bill, business expense, or any other purpose. When you’re ready, you return with the loan amount plus fees, and your watch goes back on your wrist.

Step-by-Step: What Happens When You Visit Our San Jose Pawn Shop

Walking into R & J Jewelry & Loan for the first time might feel unfamiliar if you’ve never used pawn services before. Here’s exactly what to expect:

Bring your item and ID. Arrive at our San Jose location with the item you’d like to pawn and a valid government-issued photo ID such as a driver’s license or passport. This is required by California law to verify your identity and help prevent stolen merchandise from entering the pawn system.

On-site evaluation and appraisal. One of our specialists will examine your item using professional testing tools—gold testers, diamond testers, calibrated scales, loupes, and authentication guides. For luxury watches, we check serial numbers, movements, and overall condition. This evaluation typically takes 10 to 20 minutes for most items.

Receive your loan offer. Based on the appraisal, we’ll quote you a loan amount along with a clear explanation of all terms, including the interest rate, any fees, and your repayment deadline. There’s no obligation to accept—if the offer doesn’t work for you, you’re free to take your item and leave.

Sign the pawn ticket. If you accept, you’ll sign a pawn ticket that serves as your legal contract. This document lists everything: the item description, loan amount, fees, annual percentage rate, and the exact date by which you must repay to reclaim your item.

Your item goes into secure storage. We store all pawned items in a secure, insured facility on-site. Your jewelry, watch, or handbag is protected until you return to redeem it.

Repay and redeem your item. Return anytime before your due date (or within the grace period) with the full payoff amount. We retrieve your item, and you walk out with it—no further questions asked.

If you need more time to repay your pawn loan, you can discuss options for extending your loan or arranging scheduled payments. Setting up a payment plan can help you avoid missing deadlines and make the process more manageable.

If you prefer to get a preliminary estimate before visiting, you can call ahead or schedule a video call appraisal. This saves time and helps you understand roughly what to expect before making the trip.

What to Bring With You

To get the most accurate appraisal and potentially the highest loan amount, come prepared with more than just the item itself.

Bring any documentation that supports your item’s value and authenticity:

Original box, papers, and warranty cards for luxury watches

GIA certificates or independent appraisals for diamonds

Authenticity cards and original receipts for designer handbags

Any purchase receipts or previous appraisals for fine jewelry

Your valid government-issued photo ID

These extras matter because they verify authenticity and demonstrate provenance, which can significantly increase what we’re able to offer—especially for high-demand items like Rolex watches or Hermès bags. Before your visit, consider researching similar items online to get a sense of current market values. This knowledge helps you feel confident during the appraisal process.

Types of Items You Can Use for a Pawn Loan

R & J Jewelry & Loan specializes in higher-end collateral rather than general merchandise. Unlike pawn shops that accept electronics, musical instruments, tools, or other merchandise, we focus on luxury goods where our expertise allows us to offer more competitive loan amounts. This specialization means you’re working with specialists who truly understand the value of fine jewelry, diamonds, precious metals, and designer accessories. We work hard to maintain high standards in evaluating items and providing customer satisfaction.

Not every item is a fit for a pawn loan at our shop. If something falls outside our specialty areas, our staff will let you know quickly and respectfully so you can explore alternatives. Below are the main categories we work with.

Fine Jewelry and Diamonds

We accept a wide range of fine jewelry, including engagement rings, diamond studs, tennis bracelets, gold chains, estate pieces, and designer jewelry from brands like Cartier, Tiffany & Co., and Van Cleef & Arpels. Our team includes GIA-trained gemologists who evaluate diamonds based on the four Cs: color, clarity, cut, and carat weight.

For gold jewelry, karat purity (10K, 14K, 18K, 22K) and total weight are the primary factors determining your loan amount. A substantial 18K gold chain will typically qualify for a higher loan than a lightweight 10K piece, even if they look similar. We also accept platinum and other precious metal jewelry.

Consider the difference between pawning a 1.00-carat diamond engagement ring with a GIA certificate versus a collection of scrap gold chains. The diamond ring’s documented quality and ongoing demand for certified stones may command a higher loan-to-value ratio, while scrap gold is valued primarily for its melt value based on weight and purity.

Luxury Watches (Rolex, Patek Philippe, and More)

Luxury Swiss watches represent some of our most frequently pawned items. We accept timepieces from prestigious brands including:

Rolex

Patek Philippe

Audemars Piguet

Omega

Cartier

Breitling

Richard Mille

Value depends heavily on the specific model, reference number, condition, service history, and whether you have the original box and papers. A Rolex Daytona in excellent condition with complete documentation will command a significantly different loan amount than the same model without papers showing signs of wear.

During authentication, we verify serial numbers, inspect the movement, check for bracelet stretch, and assess overall condition. For example, a Silicon Valley professional recently pawned a Rolex Datejust to cover a short-term business expense while waiting for a client payment. Within 45 days, they returned, repaid the loan, and had their watch back—no credit implications, no lengthy bank approval process.

Gold, Silver, and Other Precious Metals

Beyond jewelry, we accept gold and silver in various forms: bullion bars, coins, rounds, and even scrap pieces like broken chains or single earrings. If you have precious metals sitting unused, they can become a source of funds when you need them.

Current spot prices play a significant role in determining loan amounts for bullion and coins. We weigh items on calibrated scales right in front of you for complete transparency, and we check purity stamps (999 fine, .925 sterling, 22K, 18K, etc.) to ensure accurate valuation.

Common items we accept include:

American Gold Eagles and other government-minted gold coins

Gold bars from recognized refiners

Silver rounds and bars

Pre-1965 U.S. silver coins (90% silver content)

Canadian Maple Leafs

Scrap gold jewelry of any karat

With gold hitting record highs recently amid economic uncertainty, many Bay Area residents have discovered that jewelry or coins they’ve held for years now represent significant value. If you want to buy gold or add to your collection, our showroom also features pre-owned pieces at competitive prices.

Gold, Silver, and Other Precious Metals

Beyond jewelry, we accept gold and silver in various forms: bullion bars, coins, rounds, and even scrap pieces like broken chains or single earrings. If you have precious metals sitting unused, they can become a source of funds when you need them.

Current spot prices play a significant role in determining loan amounts for bullion and coins. We weigh items on calibrated scales right in front of you for complete transparency, and we check purity stamps (999 fine, .925 sterling, 22K, 18K, etc.) to ensure accurate valuation.

Common items we accept include:

American Gold Eagles and other government-minted gold coins

Gold bars from recognized refiners

Silver rounds and bars

Pre-1965 U.S. silver coins (90% silver content)

Canadian Maple Leafs

Scrap gold jewelry of any karat

With gold hitting record highs recently amid economic uncertainty, many Bay Area residents have discovered that jewelry or coins they’ve held for years now represent significant value. If you want to buy gold or add to your collection, our showroom also features pre-owned pieces at competitive prices.

Key Benefits of a Pawn Loan with R & J Jewelry & Loan

Why do so many San Jose residents choose pawn loans over other forms of borrowing? Here are the primary advantages:

No credit check required. Your credit score doesn’t matter. Whether you have excellent credit, poor credit, or no credit history at all, you can qualify for a pawn loan based solely on your collateral’s value.

No risk to your bank account or assets. Unlike personal loans or payday loans that can lead to overdraft fees, garnished wages, or bankruptcy proceedings if you default, a pawn loan puts only the pawned item at risk.

No debt collectors or creditors. If you can’t repay, the transaction simply ends. The shop keeps your item, and you walk away with no further obligation, no collection calls, and no negative credit reporting.

Fast cash in your hands. Most transactions at R & J Jewelry & Loan are completed in 30 to 60 minutes. You leave with money the same day you walk in.

Confidential and discreet. Your transaction is private. We don’t report to credit bureaus, and your financial circumstances remain your business.

Flexibility to redeem or extend. You can repay early to reduce costs, pay on the due date, or in some circumstances extend your loan if you need more time.

For some customers, a small loan from a bank or credit union may be a lower-cost alternative to a pawn loan, so it’s worth comparing your options before deciding.

Why Choose Our San Jose Store Over Other Pawn Options

San Jose has no shortage of pawn options, from big national chains to generic “cash for gold” storefronts. So why do customers choose R & J Jewelry & Loan?

We’ve been family-owned and operated since 1983, which means you’re dealing with people who have deep roots in this community—not a company answering to distant shareholders. Our specialization in luxury items means we have the expertise to accurately appraise high-end watches, fine jewelry, and designer goods that general-merchandise pawn shops might undervalue.

Our team includes certified gemologists and watch specialists with decades of combined experience. When you bring in a Patek Philippe or a two-carat diamond ring, you’re working with professionals who understand the nuances that affect value. This expertise translates directly into fairer, more competitive loan offers.

We also offer services that set us apart: free quotes with no obligation, the option for video call evaluations before you visit, and a clean, upscale showroom environment that feels more like a fine jewelry store than a stereotypical pawn shop. Our repeat customers return because they trust us to treat them and their belongings with respect.

Pawn Loan Costs: Rates, Fees, and How to Understand Them

Transparency about costs is essential when considering a pawn loan. Before taking out a pawn loan, review your budget carefully to ensure you can afford the repayment and avoid unnecessary financial strain. In California, pawn loan interest and fees are regulated by state law, and every pawn shop must provide you with a written breakdown before you sign anything.

Pawn loan costs typically include interest charges calculated monthly plus any applicable storage fees for holding your item securely. While the annual percentage rate on pawn loans is higher than traditional bank loans or personal loans, this reflects the short-term nature and no-credit-check convenience of the transaction. Unlike high costs associated with payday loans that can trap borrowers in cycles of debt, a pawn loan has a clear end point: you either repay and get your item back, or you don’t and the transaction closes.

Let’s walk through a concrete example. Suppose you pawn a gold bracelet and receive a $1,000 loan. Over a four-month term, your total repayment might be in the range of $1,200 to $1,300, depending on the specific rate structure. That represents your principal plus interest and any fees. Your pawn ticket will show exactly what you owe and when, so there are no surprises.

Is this more expensive than a bank loan? Yes. But consider the trade-offs: no credit check, no application process, no waiting weeks for approval, and no risk of collections or credit damage if you can’t pay. For many consumers facing unexpected expenses, these benefits outweigh the higher cost of borrowing.

How to Avoid Surprises and Keep Your Costs Down

Smart borrowing starts with honest self-assessment. Before taking a pawn loan, ask yourself: can I afford to lose this item if circumstances prevent repayment? If the answer is no, consider whether there’s a less sentimental piece you could pawn instead.

Borrow only what you truly need rather than the maximum amount offered. A smaller loan means smaller fees, and you’ll find it easier to repay on time. If you receive a $2,000 offer but only need $800, take the $800.

Pay back as early as possible when permitted. Interest typically accrues monthly, so redeeming your item sooner reduces total costs. Set calendar reminders for your due date so it doesn’t sneak up on you.

If you realize you might not be able to repay on time, call us before the deadline. Under California regulations, extensions or renewals may be available in certain circumstances. Communicating proactively shows good faith and gives us the opportunity to work with you on a solution.

Frequently Asked Questions About Pawn Loans

How long do I have to repay my pawn loan in California? California law provides for a minimum four-month loan term. At R & J Jewelry & Loan, you have this full period plus a 10-day grace period to repay and redeem your item. Your exact due date will be clearly printed on your pawn ticket.

Will a pawn loan affect my credit score? No. Pawn loans are not reported to credit bureaus. Whether you repay on time, pay early, or forfeit your item, there is no impact on your credit score. This makes pawn loans an attractive option for borrowers concerned about their credit.

What happens if I can’t repay on time? If you cannot repay by the end of your loan term and grace period, the pawn shop takes ownership of your item and may sell it to recover the loan amount. There are no collection calls, no lawsuits, and no further obligation on your part. You simply lose the item.

Can I pawn multiple items at once? Absolutely. You can bring in several items during a single visit, and each will be evaluated separately. This can be useful if you need a larger loan amount or want to diversify which items you’re using as collateral.

Is my jewelry or watch safe while it’s in your shop? Yes. All pawned items are stored in a secure, insured facility within our premises. We take product availability and security seriously—your valuables are protected until you return to redeem them.

Can I get a loan estimate over the phone or video call? Yes. We offer preliminary estimates via phone or video call so you can get a sense of value before visiting. Keep in mind that final loan offers require in-person inspection to verify condition and authenticity.

What if I change my mind after pawning an item? You can redeem your item at any time before the due date by paying the outstanding balance. There’s no penalty for early repayment, and getting your item back early means paying less in total interest.

Do you accept items that aren’t jewelry or watches? Our specialty is luxury goods: fine jewelry, diamonds, precious metals, luxury watches, and designer handbags. We do not typically accept electronics, tools, firearms, or general merchandise. If you have questions about a specific item, call us before visiting.

When a Pawn Loan Is (and Isn’t) a Good Idea

Pawn loans work best for short-term, one-time cash needs. If you’re facing an unexpected car repair, a medical bill, a security deposit for a new apartment, or a temporary gap between paychecks, a pawn loan can bridge that gap without the complications of traditional borrowing.

However, pawn loans are not designed for ongoing monthly expenses. If you find yourself considering pawning items repeatedly to cover regular bills, that’s a signal of a larger financial challenge that a pawn loan won’t solve. In those circumstances, speaking with a financial counselor or exploring other alternatives may be more helpful in the long run.

Also consider the emotional weight of what you’re pawning. Family heirloom jewelry or a watch inherited from a parent carries sentimental value that goes beyond money. If possible, pawn items with less emotional significance first. We want every customer to make decisions they’re comfortable with—our goal is to help you through a tough moment, not to acquire items you’ll regret losing.

Other Services at R & J Jewelry & Loan: Buy, Sell, and Trade Luxury Items

While pawn loans are a core part of our business, R & J Jewelry & Loan offers a full range of services for luxury goods. Beyond borrowing, you can sell items outright, shop for pre-owned luxury pieces, or trade up to something new.

This flexibility means you have options. If you’d rather convert an item into cash permanently rather than take a loan, selling might be the right choice. If you’re looking for a deal on a diamond engagement ring or a pre-owned Rolex, our showroom offers curated selections at prices well below retail. And if you want to upgrade from an older watch to a newer model, we can work with you on a trade.

Selling Your Luxury Watch, Jewelry, or Handbag

The selling process is simple: bring in your item, receive an evaluation and offer, and if you accept, walk out with cash the same day. There’s no obligation to sell if the offer doesn’t meet your expectations.

Selling makes sense when you no longer wear or use an item and would rather have funds than a possession sitting in a drawer. Luxury watch collectors in Silicon Valley frequently sell older models—perhaps a 2010 Rolex Datejust—to fund the purchase of a newer or rarer reference. Rather than deal with the uncertainty of private sale, they appreciate the convenience, security, and immediate payment we offer.

We buy gold, silver, diamonds, fine jewelry, designer handbags, and luxury watches. If you’re unsure whether your item qualifies, give us a call or stop by for a free evaluation.

Shopping Pre-Owned Luxury at Our San Jose Store

Our showroom features a rotating selection of pre-owned diamond rings, gold bracelets, Swiss watches, and designer handbags—all carefully inspected for authenticity and condition. Shopping pre-owned at R & J Jewelry & Loan can save you 30% to 50% compared to buying new from a boutique, and you’re getting quality pieces that have been vetted by professionals.

Inventory changes frequently as items are pawned, redeemed, and sold. If you’re searching for something specific—a particular Rolex reference, a Cartier Love bracelet, or a vintage Chanel bag—it’s worth visiting regularly or calling to check what’s currently available. Many of our customers have found pieces they never expected to afford, simply by browsing at the right time.

How to Get Started: Contact R & J Jewelry & Loan in San Jose

Getting quick cash through a pawn loan at R & J Jewelry & Loan is straightforward. Bring your item and valid ID to our San Jose location for a free, no-obligation quote. Our experienced staff will evaluate your piece, explain all terms clearly, and let you decide whether to proceed—no pressure, no judgment.

We’re conveniently located in San Jose, CA, with easy parking and a welcoming showroom. Our typical business hours are Monday through Saturday; we recommend calling ahead to confirm current hours or to schedule a video call appraisal if you’d prefer an initial estimate before visiting in person.

Whether you need funds for an unexpected expense or want to explore your options with luxury items you own, we’re here to help. Since 1983, we’ve built our family business on trust, transparency, and respect for every customer who walks through our doors. Your finances and your belongings are handled with care, and our goal is to provide a solution that works for your circumstances without creating long-term debt.

Visit R & J Jewelry & Loan today, give us a call, or reach out through our website to take the first step toward the cash you need.

No Credit Check: Great for those rebuilding credit or dealing with financial setbacks.

No Credit Check: Great for those rebuilding credit or dealing with financial setbacks.