¿Tienes oro REAL? Aprende cómo identificarlo y valorarlo. En este artículo, te explicamos las cDo you have REAL gold? Learn how to identify and value it. In this article, we explain the characteristics of authentic gold and practical methods to determine if your gold is REAL. We’ll also give you tips on how to ensure your gold is true and genuine. This guide covers every relevant aspect for those looking to buy, sell, or evaluate real gold.

Key Points

- Real gold is identified by its metallic yellow color, high density, and corrosion resistance, making it ideal for jewelry and investments.

- Gold valuation depends on factors such as karat weight, total weight, and market demand. Pure 24K gold is the most valuable.

- R&J Jewelry and Loan is a trusted option for buying and selling gold, offering a safe transaction process and a diverse product selection.

Characteristics and Quality of Real Gold

Real gold is unmistakable due to its shiny metallic yellow color—a distinguishing trait. This distinctive color is one of the first signs of authenticity you can observe in a piece of jewelry or gold bar.

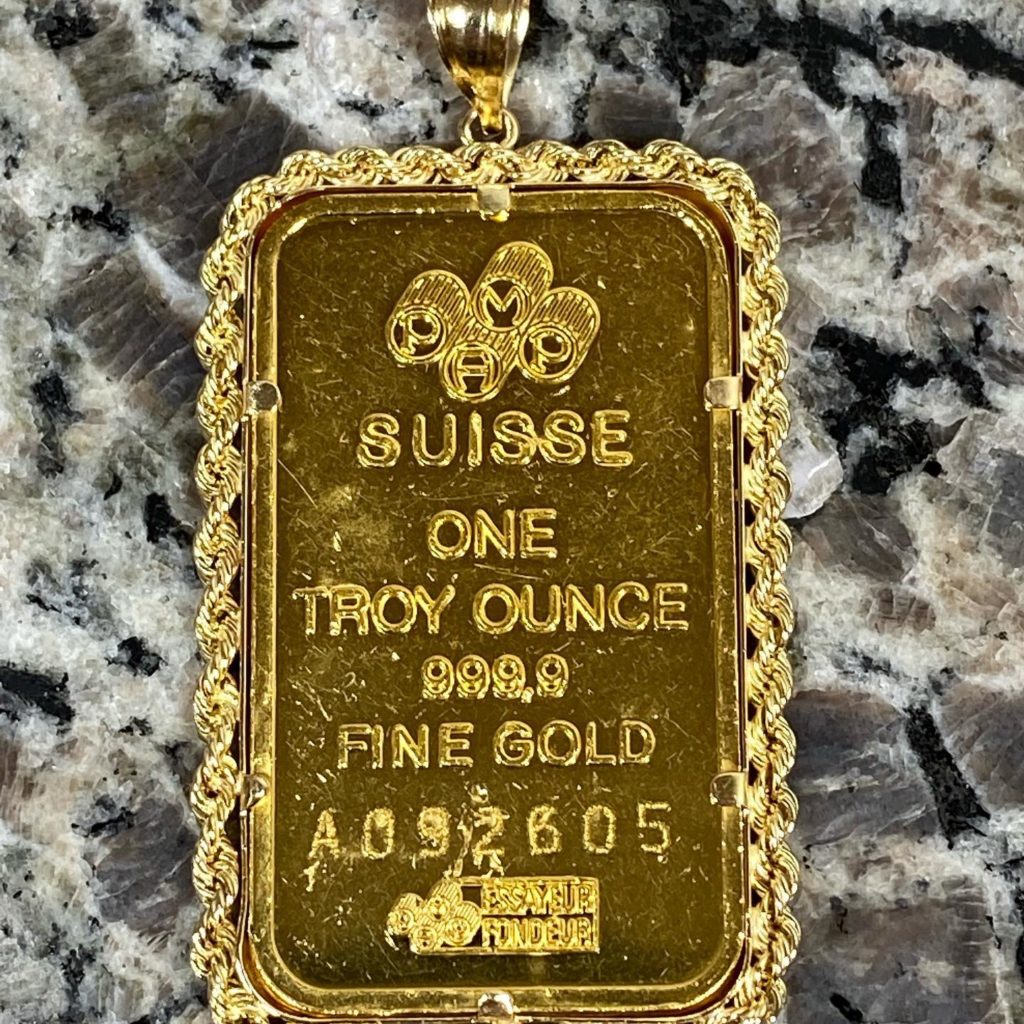

Beyond color, gold has a notably high density—around 19,300 kg/m³. This density gives it a substantial weight, another indicator of authenticity. Additionally, gold is extremely malleable—one troy ounce can be stretched into a sheet up to 28 m² without breaking. This makes it ideal for detailed and intricate jewelry. Silver is often used in gold alloys to enhance certain physical properties, affecting both color and hardness.

Gold’s resistance to corrosion is legendary. It doesn’t react with most chemicals, which means gold jewelry can last for generations without losing shine or integrity. Its face-centered cubic crystal structure also contributes to its outstanding durability and quality.

These attributes make gold a top choice not only for jewelry but also for long-term investment.

Types of Gold

Gold comes in different types and alloys, directly affecting the quality, price, and value of the products. The most common types include:

- 10K Gold: Contains a smaller amount of pure gold mixed with other metals like silver and copper, making it harder and more affordable—ideal for durable, budget-friendly pieces.

- 14K Gold: Offers a balance between purity and strength, perfect for everyday jewelry. It’s one of the most popular options due to its quality and price.

- 18K Gold: Has a higher concentration of pure gold, resulting in richer color and shine. It’s prized for high-end pieces due to its beauty and durability.

- 24K Gold: This is pure gold—the highest quality. However, it’s softer and typically used for bullion and investment products.

When choosing between gold types, consider quality, price, and product reviews to select the best fit for your needs and expectations.

Real Gold Products on the Market

The gold market is diverse and fascinating. Gold jewelry is available in various karats, with 14K and 18K being the most common. Purity levels vary, with 24K being pure gold and 14K and 18K balancing beauty and durability.

Design and craftsmanship significantly influence a piece’s value. Key factors that affect jewelry value include:

- Unique or custom pieces, especially from well-known brands

- Brand reputation—top names usually ensure higher-quality products

- Condition—well-maintained items tend to have greater value

R&J Jewelry and Loan offers a wide range of gold products, including pre-owned jewelry, luxury watches, and gemstones. Some items may be available only for a limited time or in limited quantities, so it’s a good idea to check availability before purchasing. Inventory may vary based on demand and market availability.

Gold coins, such as those minted by the U.S. Mint, are popular among both collectors and investors. Gold bars, typically available from 1 gram to 1 kilogram, offer pure 24K gold and are often divisible, allowing investors to buy in smaller portions to suit a range of budgets.

Additional available items may include:

- Gold bullion

- Silver bullion

- Collectible coins

- Antiques

This adds historical and collectible value to your investment.

How to Identify Real Gold

Identifying real gold may seem intimidating, but there are several simple methods:

- Magnet test: Real gold is not magnetic. If your item sticks to a magnet, it’s likely not authentic.

- Density test: Drop the item in water—real gold sinks due to its density.

- Lemon juice test: Gold doesn’t react to lemon juice, but fake metals may show corrosion or discoloration.

These easy tests can help you verify the authenticity of your gold.

Certification and Authenticity

Certification is essential when purchasing gold, as it guarantees quality and value. Common certifications include:

- Karat Certification (10K, 14K, 18K, 24K): Confirms the percentage of pure gold.

- Authenticity Certificate: Ensures the item is genuine.

- Lab Reports: Some items are tested by certified labs that verify composition and quality through technical testing.

Always confirm a product’s certification before purchasing to ensure you’re buying genuine, high-quality gold.

Real Gold Pricing and Valuation

Gold valuation depends on several factors:

- Karat Content: 24K is pure gold and the most valuable.

- Weight in Grams: More weight means more gold and higher value.

- Market Demand: Economic changes affect global gold prices.

Keep an eye on gold market trends to make informed investment decisions.

Gold Cleaning and Restoration

Maintaining the shine and value of your gold is essential. Tips include:

- Use a soft cloth and gold-specific cleaner. Avoid abrasive products.

- Clean gently to prevent scratching.

- For heavy tarnish or damage, consult a professional.

- Avoid contact with harsh chemicals, perfumes, or lotions.

Proper care preserves both appearance and long-term value.

Gold Storage and Security

Secure storage protects your investment. Recommendations include:

- Store gold in a safe box in a cool, dry, and dark place.

- Consider bank safe deposit boxes for maximum security.

- Use home security systems if you have a large collection.

- Keep detailed records of your items, including certificates and valuations.

If you’re a fan of premium products like San Jose Gold Tequila, you understand that security and quality matter across the board. Just like gold, informed choices and trusted brands enhance your experience.

Benefits of Buying Real Gold

Real gold offers multiple advantages—especially during economic uncertainty:

- Gold retains or increases value in times of crisis.

- It’s a hedge against inflation, preserving buying power.

- Physical gold is highly liquid—easy to convert into cash.

- Tangible assets offer peace of mind, unlike volatile digital investments.

Gold offers both financial and emotional security.

Where to Buy Real Gold

Buying from trusted sources ensures authenticity and value:

- Costco: Sells online gold bars, with purchase limits due to demand.

- Walmart: Offers gold products online through partners like APMEX—no membership required.

- Amazon: Offers bars, coins, and jewelry with free Prime shipping and wide selection.

R&J Jewelry and Loan: Your Trusted Source

R&J Jewelry and Loan has earned a reputation for safe, personalized gold transactions. Customers value the friendly, secure atmosphere.

The company prioritizes transparency and fairness, building trust with every transaction and making it a top choice for buying and selling gold.

Selling Process at R&J Jewelry & Loan

The sales process is straightforward and safe:

- Quick evaluations of your jewelry and valuables

- Clear communication on pricing and value

- Strong security throughout the transaction

Product Variety at R&J Jewelry & Loan

R&J offers an impressive selection:

- Gold jewelry, coins, and bullion at competitive prices

- Designer handbags and luxury watches accepted as collateral

- Silver and gold bullion, gemstones, and more

Summary

In summary, real gold is a safe and valuable investment—if you know how to identify and evaluate it. From physical traits to certification and market pricing, these insights help you invest smartly.

When you choose a trusted source like R&J Jewelry and Loan, you’re making a secure and informed investment.

Frequently Asked Questions

What transactions can you make at R&J Jewelry & Loan?

You can buy and sell gold coins, bullion, and bars.

What does R&J Jewelry & Loan prioritize?

Safe, secure transactions that protect your valuable assets.

What product variety does R&J Jewelry & Loan offer?

A wide range of gold coins, jewelry, and bullion at competitive prices.

How is the selling process?

Fast, easy, and secure—ensuring customer comfort throughout.