Find the best local pawn shop quickly and confidently with our “pawn shop near me” guide. Our guide eliminates the guesswork, helping you identify nearby shops for immediate cash, securing loans, or unique purchases. Learn to distinguish trusted pawn shops in your area through ratings, reviews, and essential tips—all aimed at enhancing your pawn shop near me experience.

Key Takeaways

Utilizing online reviews, personal referrals, and comprehensive online investigations are effective strategies to locate reputable and trustworthy pawn shops that offer transparent loan terms and knowledgeable staff.

Top pawn shops provide various services, such as pawn shop loans, buying and selling items, and expert appraisal services, ensuring transparency and customer understanding of all transaction terms.

Pawn shops in California operate under strict regulations that require licensing, compliance with DOJ’s Secondhand Dealer and Pawnbroker Unit, and protection against transactions involving stolen property to ensure fair and lawful operations.

Discovering the Best Pawn Shops in Your Area

Finding a reliable pawn shop may seem daunting at first, but with the right resources and knowledge, it is possible. One way to start your search is by using online reviews and ratings from platforms such as Google My Business or Yelp. These can provide valuable insights into past customer experiences and help determine the credibility of a pawn shop.

Getting recommendations from trusted sources like friends, family or colleagues who have had positive encounters with pawn shops can also help find one that you can trust. Doing thorough research on social media presence, website information, and any articles related to the specific business are ways to make an informed decision about which pawn shop will best meet your needs.

In the San Jose, CA area, there are highly rated options for pawns, including R&J Jewelry and Loan, known for their commitment to delivering excellent service while maintaining transparency through clearly defined loan fees. Experts employed in this shop are widely praised for their expertise in jewelry evaluations. But don’t forget location! It’s important to note the convenience factor when considering where to visit your chosen establishment.

Utilizing Online Reviews and Ratings

Customer reviews and ratings are highly valuable in the world of pawn shops. They provide crucial insights into a shop’s customer service, business practices, and experience. Top-rated pawn shops in San Jose have received numerous positive reviews praising their handling of personal property and excellent customer experiences. These real-life accounts from customers can serve as helpful guidance when deciding which shop to visit for pawning, selling or buying items.

Jewelry store specialized pawn shops’ reputation has been positively recognized due to their expertise in dealing with precious metals like gold, silver, and diamonds, coupled with exceptional customer service standards. To ensure a successful transaction at a pawn shop, it is important to thoroughly research online beforehand about the reputation of the particular shop you intend to visit. The key factors are its services offered, customer satisfaction levels, and trustworthiness regarding handling your valuables. As always, a thorough search goes hand-in-hand while searching for quality shops, in terms of storing, purchasing, and the best value based on an item sold off by these varied stores!

Considering Location and Accessibility

Although a shop has a good reputation and positive reviews, one cannot underestimate the importance of location and accessibility in pawn shops. Having an easily accessible shop makes it convenient for customers to get extra funds as needed, ensuring a smooth customer experience. Being close by also saves time and effort.

Location can also play a role in determining the accessibility of a pawn shop, particularly if situated in commercial areas or near public transportation, such as busy metro stations. This enables the store to cater effectively to various demographics. Regardless of its location, considerations must be made regarding compliance with state and federal laws governing secure transactions at any reputable pawn shop.

Services Offered by Top Pawn Shops Like R&J Jewelry & Loan

After selecting your desired pawn shop, it is now time to discover the services they offer. Reputable establishments like R&J Jewelry & Loan offer various options, including loans, buying and selling items, and appraisals for a wide range of merchandise. These offerings are tailored to meet the various needs of customers, from those seeking quick monetary assistance through loans to others looking for opportunities to buy or sell possessions.

Transparency and dependability play integral roles in these services. Pawn shops such as R&J Jewelry & Loan prioritize providing customers with written contracts that outline all terms involved in any transaction undertaken at their establishment. This ensures that clients have complete clarity regarding their dealings, which can help them feel confident and secure about their transactions.

Securing a Pawn Shop Loan

A pawn shop loan can be a practical solution when immediate funds are needed. To secure the loan, you will need to offer an item as collateral and agree to the terms of the loan. If renewing an existing one, you must pay off any interest due and sign a new contract at R&J Jewelry & Loan. The staff at this shop is dedicated to providing guidance throughout the entire process for a hassle-free experience.

One of the advantages of getting a pawn shop loan is its flexibility. At R&J Jewelry & Loan, they offer loans ranging from $5 up to generous amounts like thousand dollars, or even up to $250,000, with durations that can last for a set number of months. The loan setup fee used for these loans is also reasonable. This allows borrowers to find suitable financial solutions by using personal valuables as collateral.

Buying and Selling Items at Pawn Shops

Besides providing loans, pawn shops also serve as a platform for buying and selling various items. If you want to declutter or earn some additional cash, you can sell your belongings directly to the pawn shop in exchange for immediate payment. Alternatively, you may opt to use an item as collateral for a loan that must be repaid within a specified period to retrieve it.

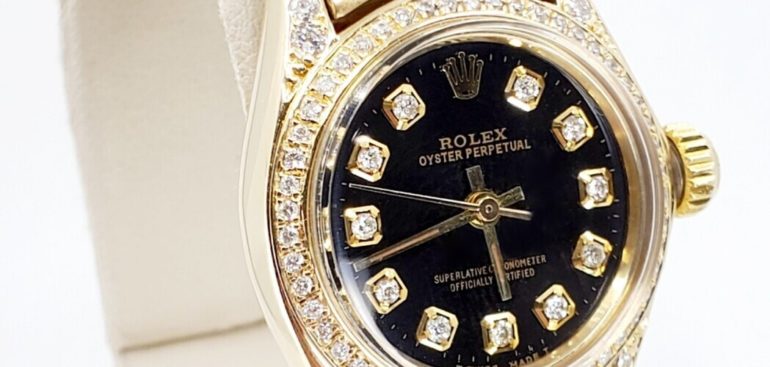

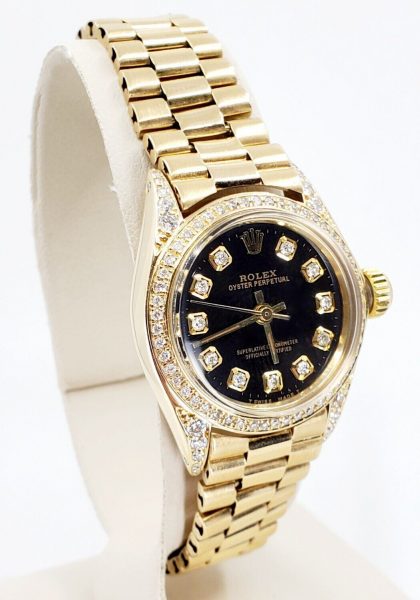

R&J Jewelry & Loan is one example of a pawn shop that offers customers options, such as purchasing or selling goods like jewelry, designer watches, and luxury handbags. Prices at these establishments are determined based on factors including rarity.

Condition of the item(s), market demand and potential resale value. So whether you’re interested in acquiring a diamond ring or getting rid of an antique clock, you can find unique opportunities through visiting different pawn shops.

Whether looking into making quick money by parting ways with unwanted possessions, such as selling jewelry, or wanting access to buy quality gems, such as diamonds, pawn shops are one of the most convenient and useful sources for both scenarios. Through their flexible services, customers have direct access to affordable deals across a range of in-demand items, making them ideal places for managing financial needs by obtaining loans using personal assets as collateral.

Appraisal Services

When visiting a pawn shop, the appraisal services provided are an integral part of the experience. These services involve a thorough assessment of several factors, such as popularity, collectibility, purity, and condition of an item, to accurately determine its market value. At R&J Jewelry & Loan, our experienced appraisers conduct visual inspections, followed by testing and verification.

In addition to determining loan amounts, appraisals also help customers understand the true value of their items. Be it jewelry or rare collectibles, at shops like R&J Jewelry & Loan, we have expertise in assessing diverse types of valuables, ensuring fair and precise valuations for our customers.

Whether you’re looking for quick cash loans against your valuable possessions or simply curious about how much they’re really worth, trust us with providing honest assessments through expert appraisal services at pawn shops like ours!

Understanding Pawn Shop Regulations in California

Pawn shops in California are subject to a set of regulations that ensure their operations are fair and lawful. These laws require all pawn shops to first obtain a license from the local licensing agency, adhere to regulations outlined by the Department of Justice’s Secondhand Dealer and Pawnbroker Unit, and maintain a $20,000 surety bond.

These rules not only guarantee the legality of pawn shop activities, but also protect customers’ rights. This is achieved through provisions such as limiting fees for loans according to guidelines established in California’s financial code section. Federal law considers pawnshops financial institutions, which adds an extra layer of accountability within their operations.

Licensing Requirements for Pawnbrokers

In California, pawnbrokers must fulfill certain licensing requirements before they can start operating their shops. These prerequisites include submitting a license application to the police chief, sheriff or police commission, obtaining and maintaining a $20,000 surety bond for financial stability, and renewing their licenses every two years.

Failure to obtain proper licensing for persons running a pawn shop can lead to serious consequences, such as fines up to $1,500 and/or maximum imprisonment of 2 months. These regulations aim at safeguarding customers’ interests and ensuring that all operations within these shops abide by the law.

Protecting Against Stolen Property Transactions

The industry of pawn shops is greatly concerned with preventing the buying and selling of stolen goods. California has put strict regulations in place under their business and professions code, also known as the professions code, to address this issue. These measures include mandatory identification for all individuals pawning or selling items, stringent reporting requirements for both pawnbrokers and secondhand store owners.

To prevent stolen property transactions, pawnshops are required by law (as they fall into the category of secondhand dealers) to report all intake activities to local authorities and keep any received property for a certain period before it can be resold. In some cases, there may even be an additional processing charge or fee applied during these types of transactions. The violation of these rules could lead to severe consequences, making them highly effective deterrents against illicit dealings involving stolen belongings.

Specialty Pawn Shops: Focusing on Jewelry and Luxury Items

While many pawn shops offer a wide variety of items, some choose to specialize in specific categories. These specialty pawn shops focus on certain types of goods, such as jewelry, luxury watches or diamonds, and provide expert knowledge and customized services for these particular items. Their staff is typically trained professionals who can accurately assess the market value, brand reputation, condition and rarity of an item.

It is important to understand the difference between a general pawn shop and one that specializes in certain products, so you can receive the best deal for your belongings. For example, if you possess antique jewelry, it would be more advantageous to bring it to a specialized jewelry pawn shop, rather than just any regular store which may not offer as high prices.

About R&J Jewelry and Loan

Located in San Jose and renowned for their exceptional service and skill, R&J Jewelry and Loan is a top-rated pawn shop. One of the distinguishing features that sets them apart from others is their extensive knowledge of evaluating various items, including jewelry, watches, and designer handbags. This ensures fair prices are given to customers who bring in these possessions.

Apart from being experts at valuation services, R&J Jewelry & Loans also prioritizes providing a secure environment for their clientele. Utilizing enhanced security measures, such as security mirrors and designated transaction areas, helps ensure the safety of both customers and merchants.

Expertise in Valuation

R&J Jewelry and Loan stands out in the pawn shop industry due to their expertise in valuation. Their professional appraisal services cover a wide range of items, guaranteeing customers receive just prices. The evaluators at R&J Jewelry and Loan are highly qualified with specialized knowledge in assessing diamonds and jewelry, many possessing GIA certification or accreditation from the American Gem Society (AGS).

At R&J Jewelry and Loan, they can appraise various goods, including diamonds, platinum jewelry, and handbags. Through skilled associates who provide expert evaluations, the company upholds its commitment to transparent pricing by striking a balance between fairness, justice, honesty, and competitive market values.

Enhanced Security Measures

Ensuring the security of customer items is a top priority at R&J Jewelry and Loan. They have established measures such as a secure physical location and a well-protected vault to store valuable items throughout the pawn loan process, giving customers peace of mind knowing that their possessions are safe.

Apart from preserving customer belongings, R&J Jewelry and Loan also prioritizes the safety of their clients within their premises. With utmost respect for collateral items in their possession, they maintain an environment with surveillance cameras and alarm systems to promote both comfort and protection during shopping experiences.

Tips for a Positive Pawn Shop Experience

Embarking on a journey through the world of pawn shops can be a satisfying experience, especially with adequate knowledge and understanding. To make the most of your visit or purchase to a pawn shop, it is crucial to develop a good relationship with your chosen pawnbroker and have an awareness of customer rights.

Establishing trust with your pawnbroker involves effective communication, clearly stating loan terms, and maintaining friendliness and respect at all times. Additionally, knowing what you are entitled to as a customer ensures fair treatment, while protecting yourself from potential disputes or misunderstandings that may arise during transactions.

Building Trust with Your Pawnbroker

Trust is a key factor in the success of any business partnership, including between you and your pawnbroker. Building trust requires effective communication through open sharing of experiences, maintaining transparency about loan terms and conditions, and creating a sense of safety for both parties.

Developing a positive relationship with your pawnbroker also involves tactics such as negotiating favorable deals, making good impressions, and showing genuine interest in their daily operations. As trust grows stronger, it leads to greater transparency, which creates a secure environment for conducting loans, while ensuring customers have excellent experience.

Knowing Your Rights as a Customer

It is important for pawn shop customers to be aware of their rights to ensure fair treatment. As a customer, you have the right to present a valid form of identification when pawning or selling items you pledge, at a pawn shop. It is against the law for pawnbrokers to sell any pledged property until they obtain legal ownership.

In California specifically, there are laws that protect customers and require them to provide proper identification during transactions involving pawning or selling goods. Pawnshops must also report all intake activities with local authorities, as mandated by these laws. It is crucial for customers to understand these rights and ensure that they are respected while conducting business at any type of establishment related, such as this one.

Things to Think About

To conclude, pawn shops offer a distinctive combination of services and possibilities for customers. These include quick loans, buying or selling items, and accurate appraisals for valuable possessions. R&J Jewelry and Loan is a highly-rated pawn shop known for their expertise, transparency, and dedication to customer satisfaction. Being familiar with the landscape of these shops, as well as the regulatory framework they abide by, can lead to a positive experience at any top-notch store like this one. So next time you enter a pawn shop, remember that it’s more than just another store – it’s an opportunity waiting to be explored.

Frequently Asked Questions

What’s the most a pawn shop will pay?

Selling to a pawn shop often results in receiving 25-60% of the item’s value, so it is crucial to keep expectations realistic. When dealing with pawn shops, managing your anticipation is essential.

What can you pawn for $50?

At a pawnshop, it is possible to exchange items such as rings, a previously owned laptop, top-notch headphones, luxury belts or sunglasses for an approximate loan amount of $50. It should be noted that the value offered for the loan will likely be less than what you could earn by directly selling these items.

Should I pawn or sell at a pawn shop?

When looking to get cash from the sale of an item, visiting a pawn shop is often more beneficial, as it typically yields a higher amount. Choosing to pawn the item instead allows you to retrieve it after paying back the loan.

It’s important to consider both your current financial needs and how much value the specific item holds, before deciding between selling or pawning at a pawn shop. Ultimately, these factors will determine whether receiving immediate money or keeping possession of your belongings in exchange for money.

How much will a pawn shop come down on price?

When you bring your items to a pawn shop, the usual offer can range from 30-60% of their value. It’s crucial to remember that the owner of these shops needs to make a profit by reselling them, so receiving more than half of the item’s value is considered favorable.

What is the pawn shop policy?

One of the policies at a pawn shop is to ask for valid identification when customers are looking to sell or pawn items. They promise they will hold onto the merchandise until the interest on any loans has been fully repaid.

In California, customers have 120 days as their loan period and must adhere to specific interest rates set by state law. This means that after borrowing a sum of money from the shop using an item as collateral, it must be paid back within four months with an agreed-upon payment.