Key Takeaways

Silver prices have surged dramatically since 2020, rising from approximately $800/kg to over $3,000/kg by January 2026, making this an opportune time for San Jose residents to evaluate their silver holdings.

2026 forecasts point to continued market volatility, with many analysts expecting average prices between $70–$100+ per ounce but warning of sharp short-term swings that could affect what you receive when selling.

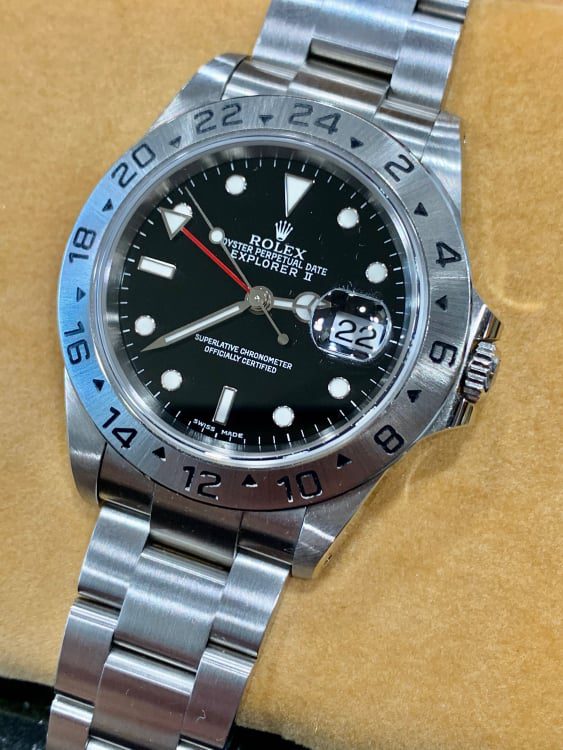

For customers of R&J Jewelry and Loan in San Jose, CA, this environment creates real opportunities to sell unwanted sterling silver jewelry, flatware, and coins at prices significantly higher than just a few years ago.

Industrial demand from solar panels, electric vehicles, and AI data centers continues to drive global silver demand, according to the Silver Institute. Silver’s antibacterial properties also make it essential in medical applications, such as wound dressings and medical devices.

Silver is also valued as a hedge against inflation and currency fluctuations, making it a safe haven asset during uncertain times.

R&J Jewelry and Loan can evaluate your silver items, explain the difference between melt value and collectible value, and help you decide whether to sell now or hold for potentially higher prices.

Silver Price Snapshot in Early 2026

If you’ve been wondering where the price of silver stands as 2026 begins, here’s the short answer: it’s significantly higher than most people expect. As of today’s price, silver is trading above $70 per ounce—equivalent to well over $3,000 per kilogram.

In January 2026, silver is trading above $70 per ounce—equivalent to well over $3,000 per kilogram. Compare that to early 2020, when prices hovered around $800/kg, and you can see why so many households are re-evaluating their jewelry boxes and coin collections. This represents a rise of several hundred percent in just six years. The lower price levels seen in previous years made silver an attractive investment opportunity for those seeking value, and the recent surge highlights the potential returns.

The recent trend shows strong gains since 2020, with notable spikes during periods of inflation concerns and geopolitical tensions. Silver reached intraday highs near $83.60 per ounce in 2025, approaching record highs, though prices have also experienced pullbacks during calmer economic periods. This pattern of sharp rises followed by corrections has become a hallmark of the current silver market.

For customers visiting pawn shops like R&J Jewelry and Loan, these numbers translate directly into what you can receive for your items. We base our offers on the live silver prices, combined with your item’s weight, purity, condition, and any collectible premium. Many San Jose residents are genuinely surprised when they learn how much their older sterling silver flatware, broken chains, or inherited silver coins are worth in this higher-price environment.

Long-Term Silver Forecast for 2026 and Beyond

No one can guarantee where precious metals prices will land by year’s end, but many analysts publish detailed ranges and scenarios for 2026, 2027, and even 2030. Analysts expectations play a crucial role in shaping market sentiment and influencing price forecasts, as investor behavior often responds to these predictions. Understanding these forecasts can help you make informed decisions about your silver holdings.

The general forecast tone leans bullish. Many research houses expect silver to stay in an elevated range throughout 2026 compared to pre-2020 levels. According to multiple analyst reports, the silver price forecast for 2026 suggests base-case scenarios in the $70–$80 per ounce range, while more optimistic projections point toward $85–$90 if industrial demand remains strong and monetary policies turn more accommodative.

Forecast Scenario | Expected Price Range | Key Assumptions |

|---|---|---|

Base Case | $70–$80/oz | Stable demand, continued deficits |

Bullish Case | $85–$90/oz | Strong industrial growth, rate cuts |

Bearish Case | $60–$70/oz | Dollar strength, investor rotation |

Long-term (2030) | $100+/oz | Sustained clean-energy demand |

Some bullish long-term projections for 2030 suggest silver could be significantly higher than 2026 levels if clean-energy demand stays strong and supply growth remains limited. Analysts from firms like US Global Investors and BNP Paribas Fortis have publicly stated expectations exceeding $100 per ounce in coming years. Is silver a good investment? Historically, silver has held intrinsic value as both a precious metal and a financial asset, making it a popular choice for investors seeking diversification and a hedge against inflation.

For everyday sellers, these forecasts matter because a tighter market usually means stronger offers for scrap, jewelry, and coins. Staff at R&J Jewelry and Loan can explain how the current day’s spot price compares to recent highs and lows, helping you decide if now feels like the right moment to sell.

Key Drivers Behind 2026 Silver Outlook

Several concrete factors are pushing analysts to maintain bullish expectations for silver in 2026. Understanding these drivers helps explain why prices remain elevated and what could push them higher—or lower—in the months ahead.

Green Energy Demand

Solar panels now consume more than 25% of global silver supply, with demand accelerating as the International Energy Agency forecasts solar capacity quadrupling by 2030. Electric vehicle production has amplified this trend, with silver demand for sensors, high-voltage wiring, and power-management systems jumping an estimated 20% in 2025 alone. The average vehicle silver loadings have been rising over the past few decades, with battery electric vehicles consuming more silver than internal combustion engine vehicles.

Interest Rates and Inflation

Stubborn inflation and expectations of Federal Reserve rate cuts through 2026 support precious metals pricing. Lower real yields reduce the opportunity cost of holding physical assets like silver, making investment in tangible metals more attractive compared to interest-bearing alternatives.

Supply Constraints

Silver primarily comes as a byproduct of gold, lead, zinc, and other metals mining, meaning price spikes don’t rapidly translate to increased output. The silver market has experienced a fifth consecutive year of structural supply deficits, with demand outpacing mine supply by 160–200 million ounces in 2025.

For San Jose, CA-area customers, these global forces quietly influence what local pawn shops can pay for silver jewelry, coins, and bullion—they all tie back to the spot price determined by worldwide supply and demand. Consider that increased California solar installations and EV adoption represent local links to this broader trend.

Short-Term Volatility: What 2026 Means Month to Month

While the long-term trend may be upward, 2026 is likely to see frequent short-term swings of several percent per week or even per day. Market volatility has become a defining characteristic of the silver market, creating both opportunities and risks for those looking to sell or invest in silver. This short-term volatility also creates opportunities for those who want to trade silver for profit, as quick price movements can be leveraged for financial gain.

Here’s a practical example: a typical ounce price might drop 2–3% on calmer economic news, then jump 4–5% when new inflation data or geopolitical tensions make headlines. In March 2026, CME Group hiked silver contract margins to $25,000, which squeezed smaller traders and contributed to additional price swings. These market fluctuations can happen quickly and unpredictably.

Why This Matters for Sellers

Selling on a “down” week could mean noticeably less cash for the same silver necklace or coin versus selling after a price bounce. The difference of a few dollars per ounce might seem small, but it adds up quickly on heavier items like flatware sets or larger coin collections.

We encourage readers in San Jose, CA to call or visit R&J Jewelry and Loan for same-day quotes, since we track current market prices and update offers accordingly. Those not in a rush might benefit from checking prices over several days to get a feel for the current range before committing to sell larger silver holdings. Some customers are also investing in silver to benefit from these price swings, aiming to maximize returns as the market fluctuates.

How Silver’s Industrial and Jewelry Demand Shape 2026 Trends

Silver isn’t just a “coin and bar” metal—its industrial and jewelry uses strongly influence price trends. Historically, silver has also served as a recognized currency and store of value, acting as a hedge against currency fluctuations and inflation. In fact, industrial demand now consumes over half of global silver demand each year, a shift that fundamentally supports prices regardless of investment flows.

Key industrial uses include electronics, solar panels, medical applications, and water purification systems, where silver’s antibacterial properties are used to destroy harmful bacteria.

Main Industrial Demand Sources

Solar panels and photovoltaics: Silver’s exceptional conductivity makes it essential for solar cell production, with manufacturers using record quantities as installations surge worldwide

Electric vehicles and electronics: Modern EVs require silver for advanced connectors, sensors, and power-management systems—demand that grows with every new model

Medical devices and specialized applications: Silver’s antibacterial properties and conductivity make it valuable in healthcare and precision instruments

AI data centers and semiconductors: Emerging applications require silver for high-efficiency electrical components and thermal management in facilities handling extreme power loads

According to the Silver Institute, industrial demand for silver—especially in sectors like solar energy, electronics, and medical technology—continues to reach new highs each year.

Jewelry and Silverware Demand

Sterling silver (92.5% pure) remains popular for rings, bracelets, chains, and designer pieces, with steady demand in fashion and bridal markets. The value of these everyday items rises alongside the global market when industrial demand is strong and mine supply is tight.

In 2026, many households are re-evaluating older silver items, choosing to sell pieces they no longer wear or use to take advantage of the stronger silver environment. That inherited flatware set or dated bracelet sitting in a drawer could be worth considerably more than you’d expect.

Sterling Silver vs. Bullion: What San Jose, CA Customers Should Understand

Understanding the difference between sterling silver and investment-grade bullion helps you know what your items are actually worth.

Type | Purity | Common Forms | Valuation Notes |

|---|---|---|---|

Sterling Silver | 92.5% | Jewelry, flatware | Adjusted for lower purity |

Fine Silver Bullion | 99.9% | Bars, rounds | Valued at full silver content |

Coin Silver | 90% | Pre-1965 U.S. coins | Historical premium possible |

When selling silver coins and small bars, be aware that there may be additional costs such as melting, casting, stamping, VAT, and trading spreads. These expenses can impact the final payout you receive.

Pawn shops like R&J Jewelry and Loan calculate offers by adjusting for purity, so a sterling chain is valued differently than a .999 fine silver round of the same weight. The math is straightforward: sterling contains about 7.5% less pure silver per ounce than bullion.

Bring in any hallmarked items—look for stamps like “925,” “Sterling,” or coin purity markings—so staff can test, weigh, and provide an offer based on real silver content and today’s price. Some branded or vintage pieces can be worth more than melt value if they have designer, collectible, or antique appeal. Our team can advise when this applies and help you understand whether selling for melt or as a collectible makes more sense.

Practical Tips for Selling Silver in 2026 at R&J Jewelry and Loan (San Jose, CA)

Whether you’re a first-time seller or have sold silver before, understanding the process helps you get the best possible outcome.

Common Items San Jose Customers Bring In

Broken or unused jewelry (chains, bracelets, rings)

Sterling silver flatware sets

Silver coins (both numismatic and bullion)

Small silver bars and rounds

Scrap silver from estate cleanouts

Before You Visit

Check your items for markings before coming to the shop. Common hallmarks include:

925 or Ster: Sterling silver (92.5% pure)

999 or Fine Silver: Investment-grade bullion

900 or Coin: Often found on older U.S. coins

800: European silver standard

Separate clearly marked silver items from costume jewelry. Items marked “EPNS” (Electroplated Nickel Silver) or “Silverplate” contain minimal actual silver and won’t have significant melt value.

The In-Store Process

When you visit R&J Jewelry and Loan, here’s what to expect:

Visual inspection: We examine markings and overall condition

Testing: Magnet test, and if needed, acid or electronic testing to confirm purity

Precise weighing: Items are weighed on calibrated scales

Offer explanation: We explain how the offer ties to that day’s silver prices, weight, and purity

You can ask staff exactly how much of the offer is based on silver melt value versus any additional premium for collectible coins, branded jewelry, or rare pieces. We want you to understand the breakdown so you can make an informed decision.

Timing Your Sale: Should You Sell Silver Now or Wait?

There’s no perfect answer to this question, but practical guidelines can help you decide based on your situation.

If You Need Cash Now

Customers who need immediate money—paying bills, handling emergencies, or funding purchases—might prioritize their financial needs over trying to catch the very top of the market. Past performance shows that timing the exact peak is nearly impossible, even for professional investors.

If You’re Holding as an Investment

For those holding larger amounts of silver bullion or coins purely for investment purposes, consider whether you believe industrial demand and inflation will remain strong. Are you comfortable with potential price drops if the dollar strengthens or interest rates rise unexpectedly?

Our staff can discuss how current offers compare with what customers might have received in previous years. This context helps you understand just how much the silver investment landscape has shifted.

A Middle-Ground Approach

Some sellers choose to liquidate part of their silver holdings now—especially items they don’t wear or use—and keep the rest if they’re optimistic about longer-term 2026–2030 forecasts. This strategy lets you gain exposure to continued upside while converting unused items to cash.

Buying Silver in 2026: Opportunities and Cautions for Local Shoppers

Some San Jose, CA customers visit R&J Jewelry and Loan not to sell but to buy silver jewelry, coins, or occasionally bullion to benefit from long-term trends. While some investors choose to diversify between silver and stocks, especially since stocks can sometimes decline when precious metals like silver perform well, others focus on silver as a hedge or alternative investment. In a higher-price, higher-volatility year like 2026, buyers should be especially careful about authenticity, purity markings, and the premium they pay over melt value.

A reputable pawn shop inspects silver items before putting them in the display case, helping buyers avoid counterfeits or mis-stamped pieces. This vetting process protects both parties and ensures you’re getting legitimate physical precious metals.

Clarify Your Goal Before Buying

Goal | Best Options | What to Consider |

|---|---|---|

Beauty and wear | Jewelry pieces | Design, craftsmanship, personal style |

Collecting | Vintage or rare coins | Condition, rarity, authentication |

Silver weight | Bullion-style pieces | Premium over spot, liquidity |

Our staff can point out which items are closer to melt value and which carry a larger design or collectible premium. Understanding this distinction helps you know exactly what you’re paying for in 2026’s market.

How Much Silver Should the Average Person Own?

There’s no one-size-fits-all rule for how much to invest in silver. Many personal finance commentators suggest keeping only a small percentage of total savings in commodities or precious metals—often cited as 5–10% of a portfolio for those seeking diversification.

Before committing significant funds to buy silver or buy gold, consider:

Your income stability and job security

Emergency savings (typically 3–6 months of expenses)

Outstanding debts and their interest rates

Your retirement account contributions

Your comfort with risk and market volatility

R&J Jewelry and Loan does not provide formal tax advice or investment recommendations, but we can explain the practical differences between owning jewelry, coins, and bullion from a pawn-shop perspective. Customers wanting tailored investment guidance—especially regarding exchange traded funds, mutual funds, futures contracts, or how silver fits into a broader portfolio—should consult a licensed financial professional.

Any investment involves risk. Future results cannot be predicted based on past performance, and any liability arising from making investment decisions based on general information rests with the individual investor.

How R&J Jewelry and Loan Helps San Jose Customers Navigate 2026’s Silver Market

For San Jose residents, R&J Jewelry and Loan serves as a neighborhood resource for understanding and acting on silver market trends. Silver has been used as a store of wealth for over 5,000 years, dating back to ancient times, which highlights its enduring value and importance. Whether you’re evaluating inherited silver, trying to distinguish sterling from plated items, or simply wanting to convert unused pieces into cash, we’re here to help.

We monitor current silver prices daily, so our offers and inventory reflect real-time 2026 market conditions rather than outdated price lists. When you bring in items, you’re getting valuations based on what silver is actually trading for that day—not last month or last year.

Our staff can walk first-time sellers through each step of the process, answer questions about weight and purity, and provide quotes with no obligation to sell. We understand that for many people, this is their first time selling precious metals, and we take the time to make sure you feel comfortable with the process.

If you’re in or near San Jose, CA, we encourage you to bring in your silver pieces or schedule a visit. This is especially valuable if you have older items whose value you haven’t checked in several years—you might be pleasantly surprised by what the 2026 market offers.

Visit R&J Jewelry and Loan to learn more about our services or stop by for a no-obligation evaluation of your silver items.

FAQ: Silver Trends in 2026 and Local Pawn Shop Questions

Q: Is 2026 a good year to finally sell my old silver jewelry and flatware?

A: With silver prices significantly higher than the mid-2010s and early 2020, many San Jose, CA residents find 2026 an attractive time to sell pieces they don’t use. The “right” time depends on personal needs and comfort with future price uncertainty—no one knows exactly where prices will go next. R&J can provide a no-pressure quote based on current market levels so you can see exactly what your items are worth today.

Q: Do pawn shops in San Jose, CA pay full silver spot price for my items?

A: Pawn shops typically pay a percentage of the underlying silver value to cover refining costs, overhead, and market risk. At R&J Jewelry and Loan, we show you how the offer relates to weight, purity, and that day’s spot price so you understand the breakdown. This transparency helps you evaluate whether our offer works for your situation.

Q: How can I tell if my items are real silver before I bring them in?

A: Look for hallmark stamps such as “925,” “Sterling,” “800,” or purity marks on coins. Many plated items are marked “EPNS” or “Silverplate”—these contain minimal actual silver. If you’re unsure, bring uncertain pieces to our shop. We’ll test them in-store using professional methods and give you a definitive answer at no charge.

Q: Are my collectible silver coins worth more than their melt value in 2026?

A: Some coins carry additional numismatic (collector) value beyond their silver content. This is especially true for older U.S. silver coins, limited-mintage bullion issues, or coins in excellent condition. R&J Jewelry and Loan can assess both the silver content and any collectible premium when making an offer, helping you understand whether selling for metal value or to a collector makes more sense.

Q: Can I use my silver as collateral for a loan instead of selling it?

A: Yes. Many pawn shops, including R&J Jewelry and Loan in San Jose, CA, offer short-term loans using silver jewelry, coins, or bullion as collateral. You receive cash based on a percentage of the item’s value, and you can reclaim your items by repaying the loan according to agreed terms. This option works well for those who need temporary liquidity but want to retain ownership of their physical assets.

Q: How do political developments and geopolitical tensions affect silver prices?

A: Silver often acts as a safe haven asset during periods of uncertainty. When stock markets experience turbulence or political developments create economic concerns, investors sometimes move money into commodities like gold and silver. This increased demand can push prices higher in the short term, though the relationship isn’t always predictable. The two metals—gold and silver—often move together during risk-off periods, though silver tends to be more volatile due to its smaller market and dual industrial-monetary role.