The holiday season is around the corner, and it’s a time for joy, celebration, and sharing the love with your friends and family. It’s also a season that often comes with a long shopping list, whether you’re buying gifts for loved ones, decorating your home, or simply treating yourself to something special. However, finding the perfect gifts without breaking the bank can be a challenge. That’s where R&J Jewelry and Loan, a pawn shop located in San Jose, CA, steps in. Specializing in pre-owned gold, diamond, and silver jewelry, R&J Jewelry and Loan offers a unique opportunity for holiday shoppers to find high-quality gifts for less money. In this blog, we’ll explore why pawn shops like R&J Jewelry and Loan are a safe and attractive option for holiday shopping, and how they provide a wide variety of unique items that can be challenging to find elsewhere.

The Joy of Holiday Shopping

The holiday season is a time of year that brings people together to celebrate traditions, exchange gifts, and make cherished memories. From decking the halls with festive decorations to savoring delicious holiday meals, there’s a sense of warmth and happiness in the air. However, one aspect of the season that can create stress is gift shopping. The pressure to find the perfect presents for loved ones while staying within your budget can be a real challenge.

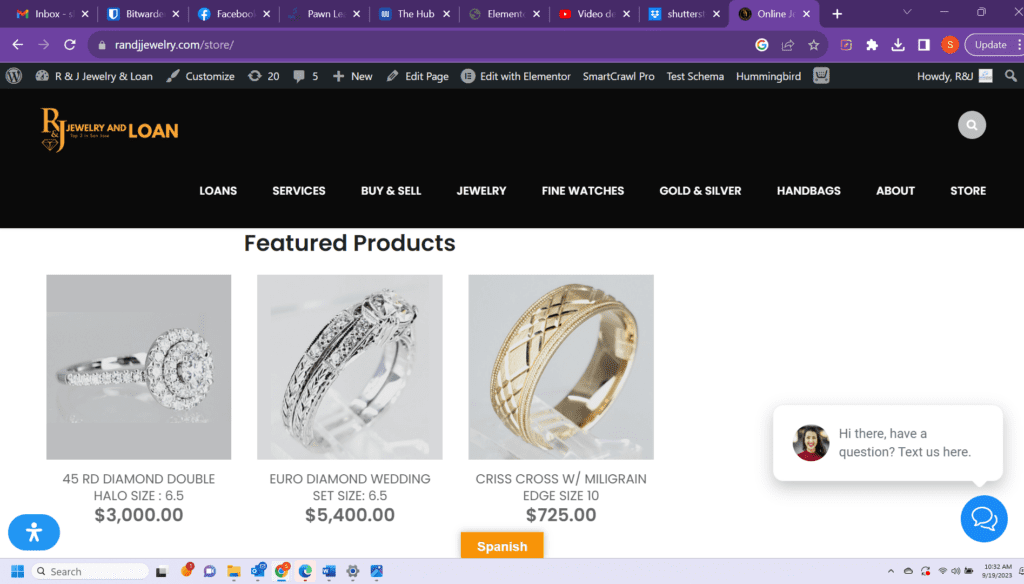

This is where R&J Jewelry and Loan shines as a safe and attractive solution for holiday shopping in San Jose, CA. The store will buy, sell, and pawn luxury items. They have a certified gemologist on their team who can help you get the most for your diamonds if you sell or pawn them, and who knows how to purchase pre-owned jewelry inventory so that the jewelry they offer is real. The pawn shop offers more quality for less money.

Quality Pre-Owned Gifts

R&J Jewelry and Loan specializes in pre-owned gold, diamond, and silver jewelry. Why should you consider pre-owned jewelry a gift option? Here are some compelling reasons:

1. Affordability:

Pre-owned jewelry is more budget-friendly than buying brand-new pieces. You can get high-quality gifts without the hefty price tag.

2. Sustainability:

Choosing pre-owned jewelry is an eco-friendly choice. By purchasing pre-owned items, you’re participating in responsible consumption.

3. Unique Selection:

Pre-owned jewelry often includes unique and vintage pieces that may not be available in traditional retail stores. This adds an element of exclusivity to your gifts.

4. Quality Assurance:

Reputable pawn shops like R&J Jewelry and Loan authenticate and test items rigorously before putting them on display. This ensures that the jewelry you purchase is genuine and of high quality.

5. Historical Significance:

Some pre-owned pieces may come with a rich history, making them even more meaningful as gifts.

Safety in Shopping

Safety is a top priority when it comes to holiday shopping, especially in an era where online and in-person transactions can come with risks. When you choose R&J Jewelry and Loan for your holiday shopping, you can be confident in the safety and legitimacy of your purchases. Here’s why:

1. Reputation and Trustworthiness:

R&J Jewelry and Loan is a reputable and established pawn shop in San Jose, CA, known for its honest and ethical business practices. They’ve built trust in the community over the years.

2. Authentication and Testing:

All items, including pre-owned jewelry, are thoroughly authenticated and tested for quality before being offered for sale. This ensures you’re receiving the value you pay for.

3. Knowledgeable Staff:

The team at R&J Jewelry and Loan is highly knowledgeable and can help you make informed decisions. Whether you have questions about a particular piece or need advice on finding the perfect gift, they’re there to help.

4. Security Measures:

The physical location of R&J Jewelry and Loan is designed to provide a secure and comfortable shopping environment.

The Wide Variety of Gifts

One of the standout advantages of shopping at R&J Jewelry and Loan is the wide variety of items available. While they specialize in pre-owned jewelry, you’ll find various other gifts that can make the holiday season even more special. Here are some categories of gifts you can explore:

1. Jewelry:

The selection includes rings, necklaces, bracelets, earrings, and more. From classic designs to unique and vintage pieces, there’s something for everyone.

2. Watches:

High-quality watches make for timeless gifts. Whether you’re looking for a stylish timepiece or a functional watch, you’ll find plenty of options. R&J Jewelry and Loan has a large inventory of luxury watches like Rolex.

3. Collectibles:

Pawn shops sometimes have unique collectibles and antiques that can be wonderful gifts for those who appreciate history and art.

6. Luxury Handbags:

Luxury pre-owned handbags make exceptional gifts for several reasons. They combine timeless style with enduring quality, offering a piece of luxury that can be cherished for years to come. These bags often carry a unique charm, with their history and craftsmanship, making them stand out from brand-new counterparts. Moreover, choosing pre-owned handbags is an eco-conscious decision, contributing to sustainable consumer practices. Whether it’s a classic Chanel or an iconic Louis Vuitton, gifting a luxury pre-owned handbag conveys thoughtfulness, style, and extravagance, ensuring your loved one receives a meaningful and sophisticated present.

The wide variety of gifts available at R&J Jewelry and Loan ensures that you can find something special for every person on your holiday list, from jewelry enthusiasts to tech lovers and DIY aficionados.

Why Choose R&J Jewelry and Loan

There are several compelling reasons to choose R&J Jewelry and Loan for your holiday shopping needs:

1. Experience and Reputation: R&J Jewelry and Loan has been serving the San Jose community for years, building a strong reputation for trustworthiness and quality.

2. Quality Assurance: Every item is carefully authenticated and tested, ensuring that you receive top-notch quality.

3. Eco-Friendly Choices: By shopping for pre-owned items, you’re contributing to a more sustainable and eco-friendly world.

4. Unique Selection: You’ll find unique and one-of-a-kind items that can’t be easily replicated elsewhere.

5. Budget-Friendly Options: You can stretch your budget further by choosing pre-owned gifts, allowing you to get more for your money.

6. Knowledgeable Staff: The team at R&J Jewelry and Loan is well-informed and ready to assist you in finding the perfect gifts.

7. Safe and Secure Environment: The pawn shop is designed to ensure a secure and comfortable shopping experience.

Gifting with Heart

Holiday shopping is more than just crossing items off your list; it’s about finding gifts that reflect your thoughtfulness and love. At R&J Jewelry and Loan, you’ll discover a treasure trove of pre-owned gifts that carry a sense of history and uniqueness. When you give a pre-owned gift, you’re not just giving an object; you’re sharing a story. Whether it’s a vintage necklace with timeless elegance, a classic wristwatch that’s seen decades pass, or an antique collectible that sparks nostalgia, these items come with character and a sense of connection that new purchases can’t replicate.

The Ethical Aspect of Pre-Owned

In today’s world, where sustainability and ethical consumerism are on the rise, pre-owned gifts carry an extra layer of appeal. When you choose pre-owned jewelry, or other items, you’re participating in sustainable consumption. By giving pre-owned gifts, you’re helping reduce the demand for new production and lessen the environmental footprint.

Furthermore, when you buy from a reputable pawn shop like R&J Jewelry and Loan, you’re engaging in ethical consumerism. You’re supporting local businesses and contributing to the local economy. Your purchases help sustain the community and ensure the growth of local enterprises, creating a positive impact in your area.

Finding the Perfect Jewelry Piece

Jewelry holds a special place in the world of gift-giving. It’s a timeless symbol of love and appreciation, and it’s often a gift that holds sentimental value for years to come. At R&J Jewelry and Loan, you can find the perfect jewelry piece that matches the recipient’s style and taste. Here are some popular options you can explore:

Classic Elegance: Discover timeless pieces such as solitaire diamond necklaces, pearl earrings, and gold bangles that exude classic elegance.

Statement Jewelry: For those who love to make a statement, look for bold and unique pieces like gemstone-encrusted rings, oversized vintage brooches, and chunky silver bracelets.

Vintage Charm: Vintage jewelry has a charm all its own. Consider selecting a piece from a particular era, like Art Deco, Art Nouveau, or the Victorian era.

Personalized Jewelry: Many pawn shops offer personalized jewelry, from engraved pendants to birthstone-studded rings. These pieces can carry extra sentimental value.

Designer Labels: If you’re shopping for someone who appreciates designer brands, check out pre-owned designer jewelry, which often comes with significant cost savings compared to new pieces.

Holiday Shopping with a Budget

One of the most significant benefits of holiday shopping at a pawn shop like R&J Jewelry and Loan is the budget-friendly aspect. In the holiday season, expenses can quickly add up, and it’s essential to find ways to make your budget go further. Pre-owned gifts offer excellent value for money, allowing you to acquire high-quality items without the premium price tags. This means you can cross off all the names on your gift list without overspending.

With the money you save by choosing pre-owned gifts, you can add extra touches to your holiday celebrations. Perhaps you can plan a special holiday meal, invest in personalized gift wrapping, or even book a memorable experience for your loved ones. The budget-friendly aspect of shopping at R&J Jewelry and Loan ensures that your holiday shopping is not only cost-effective, but also rewarding.

The Joy of Discovery

Holiday shopping at a pawn shop is a unique experience that brings the joy of discovery. As you browse the shelves and display cases, you never know what hidden gems you might encounter. From vintage collectibles to rare antiques, there’s excitement in the hunt for that perfect gift. This element of surprise adds a special touch to the holiday season.

In addition to the wide variety of items, the ever-changing inventory at pawn shops means every visit can yield new and exciting finds. It’s a shopping adventure that keeps the holiday spirit alive and brings a sense of wonder to your gift selection process.

Gift-Giving Made Memorable

Ultimately, the holidays are about creating memorable moments and cherishing time with your loved ones. Your choice of gifts plays a significant role in this experience. At R&J Jewelry and Loan in San Jose, CA, you can discover gifts with history and heart, knowing that each piece has a unique story to tell. Whether it’s a piece of jewelry that glistens with elegance, an antique collectible that sparks nostalgia, or a personalized item that conveys your thoughtfulness, your gifts from R&J Jewelry and Loan will make the holiday season even more special.

In conclusion, consider the charm and affordability of pre-owned gifts as you prepare for the holiday season. R&J Jewelry and Loan in San Jose, CA, is a safe and trustworthy destination for your holiday shopping needs. It offers a wide variety of unique items that you won’t find elsewhere. These pre-owned gifts have character, history, and sustainable appeal, making them a thoughtful and ethical choice for your loved ones. Make your holiday gift-giving memorable and budget-friendly by choosing quality pre-owned gifts from R&J Jewelry and Loan. Your gifts will not only be cherished, but will also carry a story of uniqueness and connection, making the holiday season even more delightful.

With R&J Jewelry and Loan, your holiday shopping becomes an adventure of discovery, where every visit brings the excitement of finding that perfect gift. As you explore the ever-changing inventory, you’ll uncover hidden gems that will bring joy to your loved ones’ faces. Make this holiday season one to remember with the timeless appeal of pre-owned gifts from R&J Jewelry and Loan.

The holiday season is a time of joy, togetherness, and sharing love with your friends and family. It’s also a time when gift shopping can create financial stress. R&J Jewelry and Loan in San Jose, CA, offers a solution by specializing in pre-owned gold, diamond, and silver jewelry, as well as various other gifts. By choosing pre-owned gifts, you can enjoy the affordability, sustainability, and uniqueness they offer. Additionally, shopping at R&J Jewelry and Loan ensures safety and trustworthiness in your transactions, making it a smart choice for your holiday shopping needs.

This holiday season, make your gift-giving memorable and budget-friendly by choosing quality pre-owned gifts from R&J Jewelry and Loan. Whether you’re seeking jewelry, electronics, tools, or unique collectibles, R&J Jewelry and Loan has you covered, ensuring that your holiday shopping is a joyful and satisfying experience.