In a world of complexities, where choices abound, A simple word emerges, like a gentle, sacred sound. It carries all the weight of dreams and futures yet untold, A word that needs no flourish, a word that’s pure as gold.

“Yes,” she softly whispers, a single, precious word, In that fleeting moment, all uncertainties are blurred. No grand declaration, no need for a parade, Just a heartfelt affirmation of the love that won’t fade.

In the simplicity of “yes,” two souls become as one, A journey filled with laughter, where love has just begun. No need for lengthy speeches, no need for grand display, Just a single word that changes life in a beautiful way.

It’s in the sparkle of her eyes, the warmth within her smile, In that one word, a promise to go that extra mile. With “yes,” they choose forever, with all its ups and downs, Through every storm and sunshine, they’ll stand on solid grounds.

So, let us not forget the power that lies within, The beauty of a moment where love begins to spin. In the simplicity of “yes,” a lifetime’s story starts, Two hearts forever intertwined, two souls with beating hearts.

For in that sacred instant, when love finds its own way, A single word can change the world and brighten up the day. The beauty of “yes” is found in love’s purest art, A simple word, a sacred bond, a brand-new, wondrous start.

Are You Ready to Say ‘Yes’ or Know? The Diamond Engagement Ring

Deciding whether you are ready to accept a marriage proposal is a deeply personal and significant decision. It’s important to consider various factors and engage in open and honest communication with your partner. Here are some key considerations to help you determine if you are ready:

Emotional Readiness:

- Love and Commitment: Do you genuinely love and care for your partner? Are you committed to building a life together?

- Emotional Stability: Are you emotionally stable and capable of handling the challenges and joys that marriage may bring?

- Trust and Communication: Do you have a strong foundation of trust and open communication with your partner?

Timing:

- Personal Goals: Consider your individual goals, such as career aspirations, personal growth, and life experiences. Are you at a point where you feel comfortable adding marriage to your life plan?

- Relationship Duration: The length of your relationship can influence your readiness. Some couples are ready to marry after a short time, while others prefer a longer courtship.

Financial Preparedness:

- Financial Stability: Are you both financially stable or have a plan to work toward financial stability together? Discuss your financial goals, budgeting, and how you will handle financial matters as a married couple.

- Shared Financial Values: Do you share similar financial values and priorities? It’s essential to be aligned in your approach to money matters.

Family and Support:

- Family and Friend Support: Consider the support and approval of your families and close friends. While their opinions shouldn’t dictate your decision, their support can be meaningful.

- Shared Values and Beliefs: Ensure that you and your partner share important values and beliefs related to family, religion, and lifestyle.

Commitment and Responsibility:

- Responsibility Towards Each Other: Are you both prepared to take on the responsibilities of marriage, such as supporting each other emotionally, physically, and financially?

- Conflict Resolution: How well do you and your partner handle conflicts and disagreements? Effective conflict resolution is crucial in a lasting marriage.

Life Vision and Compatibility:

- Life Goals: Do you and your partner have compatible life goals and visions for the future? Consider your desires for children, career, travel, and where you want to live.

- Lifestyle Compatibility: Evaluate whether your lifestyles, interests, and routines are compatible. It’s essential to have shared activities and interests that bring you closer together.

Personal Growth and Independence:

- Independence: Ensure that you both maintain a sense of individuality and personal growth within the relationship. Marriage should enhance your lives, not stifle personal development.

Legal and Practical Considerations:

- Legal Matters: Familiarize yourselves with the legal aspects of marriage, such as marriage licenses, prenuptial agreements (if desired), and the legal implications of marriage in your jurisdiction.

Intuition and Gut Feeling:

- Trust Your Instincts: Ultimately, trust your instincts and feelings. If you have a deep sense of happiness, security, and confidence about marrying your partner, it may be a positive sign.

How Do You Prepare to Propose?

Preparing to propose is a significant and memorable moment in a person’s life. It’s essential to plan thoughtfully and consider your partner’s preferences and personality. Here are some steps to help you prepare for the proposal:

-

Know Your Partner’s Desires:

- Take time to understand your partner’s expectations and preferences regarding the proposal. Some people prefer private, intimate moments, while others may enjoy a more elaborate event.

- Pay attention to hints or conversations about engagement rings, proposal locations, and romantic gestures.

-

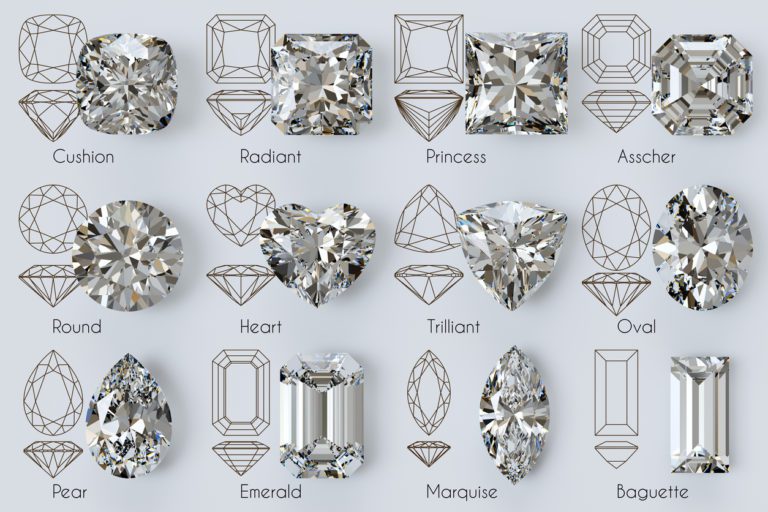

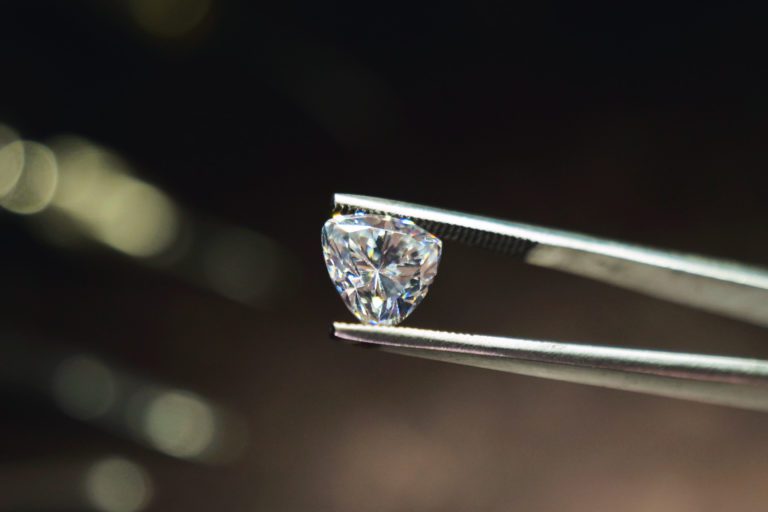

Select the Right Engagement Ring:

- If you plan to propose with a ring, choose an engagement ring that you believe your partner will love. Consider factors like the style, metal type, and gemstone or diamond.

- If you’re uncertain about the ring, you can propose with a temporary or placeholder ring and shop for the actual engagement ring together later.

-

Budget Wisely:

- Set a budget for the engagement ring and the proposal itself. It’s essential to have a clear understanding of your financial situation and avoid going into debt.

-

Choose a Meaningful Location:

- Select a location that holds special significance for both of you. It could be where you first met, a favorite park, a beach, or a place that represents a shared memory.

- Ensure the location aligns with your partner’s preferences, whether they prefer private or public settings.

-

Plan the Date and Time:

- Consider the date and time of the proposal carefully. Some people prefer daytime proposals, while others find evening or nighttime settings more romantic.

- Check the weather forecast if you plan an outdoor proposal, and have a backup plan in case of adverse weather conditions.

-

Involve Friends and Family (if desired):

- If your partner values family and friends’ presence during such a moment, consider including them in the proposal. This could involve having loved ones nearby to celebrate afterward or capturing the moment with photographs or videos.

-

Practice Your Words:

- Think about what you want to say when you propose. You don’t need a lengthy speech, but expressing your feelings and intentions from the heart is important.

- Practice what you’ll say to ensure you convey your emotions sincerely.

-

Plan the Surprise Element:

- Create an element of surprise in your proposal to make it memorable. This could involve unexpected details, such as a hidden photographer or a heartfelt letter.

-

Capture the Moment:

- Arrange for someone to capture the proposal on camera or video if you wish to have a record of the moment. Alternatively, you can hire a professional photographer for a surprise proposal shoot.

-

Have a Plan B:

- Life is unpredictable, so it’s wise to have a backup plan in case things don’t go as expected. Flexibility is key to ensuring the proposal remains a special and memorable event.

-

Relax and Enjoy the Moment:

- On the day of the proposal, take a deep breath and relax. Trust your preparation and let your genuine emotions shine through.

- Remember that proposals are meant to be special and heartfelt, so focus on expressing your love and commitment.

Preparing to propose is an exciting and emotional journey. It’s all about creating a moment that reflects your love and your partner’s desires. Tailor the proposal to your unique relationship, and above all, cherish the love and connection you share.

R&J Jewelry and Loan in San Jose, CA

It doesn’t matter if you are selling a diamond for quick cash, or considering buying a pre-owned lab created or natural diamond as an engagement ring, R&J Jewelry and Loan has a large inventory of quality jewelry.

R&J Jewelry and Loan is a pawn shop located in San Jose, CA.

There are several factors that make them a good place to shop:

Reputation and Trustworthiness: They have a solid reputation in the community. Positive reviews, customer testimonials, and a history of ethical business practices can instill confidence in customers.

Fair Appraisals: Customers can expect fair and accurate appraisals of their diamond jewelry when selling or pawning. They employ knowledgeable experts who can assess the value of diamonds fairly.

Transparency: Known for their transparency about the evaluation process, pricing, and terms of their transactions, customers fully understand the terms and conditions before proceeding.

Competitive Offers: Whether you’re buying, selling, or pawning, the shop offers competitive prices or loan terms in line with market rates. They negotiate and accommodate customers’ needs.

Secure Transactions: The safety and security of your valuable jewelry is top priority at R&J Jewelry and Loan. They are a reputable shop with measures in place to ensure the security of your items while they are in their possession.

Wide Selection: For buyers, as a jewelry shop, they have a diverse selection of diamond jewelry, including engagement rings. This allows customers to find pieces that match their preferences and budget.

Customer Service: The shop is known for its exceptional customer service, including friendly and knowledgeable staff, which can enhance the experience when dealing with their jewelry and loan shop.

Legal Compliance: The shop operates within the bounds of local and state laws and regulations related to pawnshops and jewelry sales.

Customer Reviews and Recommendations: Reading online reviews and asking for recommendations from friends or family members who have experience with the shop can provide insights into its reputation and quality of service. You will find that R&J Jewelry and Loan is highly recommended.