Are you in need of quick cash but don’t have a good credit score or a bank loan? A pawn loan might be the solution you are looking for. Pawn loans have been around for centuries and are a popular way to get cash fast without a credit check.

Pawn loans are a type of secured loan that requires you to use an item of value, such as jewelry or a musical instrument, as collateral. When you take out a pawn loan, you are essentially borrowing against the value of that item.

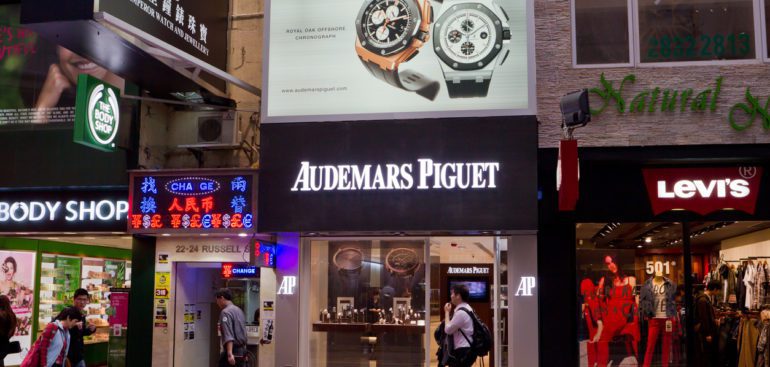

If you live in or near San Jose, CA, R&J Jewlery and Loan offers no hassle collateral loans on luxury items.

Quick cash may be what you need to get you through until your other cash source comes in. The pawnbrokers at R&J Jewelry and Loan will work with you to help you get the most for your items.

If you are new to pawn loans, you might have some questions. How do they work? How much money can you borrow? What happens if you can’t repay the loan? In this beginner’s guide, we will cover everything you need to know about getting a pawn loan, including collateral loans, pawnshop loans, and secured loans.

We’ll walk you through the steps of getting a pawn loan, from finding a reputable pawnshop to assessing the value of your item. We’ll also explain what happens if you can’t repay the loan, so you can make an informed decision about whether a pawn loan is the right option for you. By the end of this guide, you’ll be equipped with the knowledge you need to get a pawn loan and use it responsibly.

What is a Pawn Loan?

A pawn loan is a type of secured loan that requires you to use an item of value, such as jewelry or a musical instrument, as collateral. The pawnbroker will assess the value of the item and lend you money based on that value. If you repay the loan with interest, you can get your item back.

Collateral Loans

Collateral loans are a type of loan that requires you to put up something of value, such as a piece of jewelry or a vehicle, as collateral in case you cannot repay the loan. The value of the collateral is assessed by the lender, and the loan amount is based on that value.

Collateral loans are a popular option for those who do not have good credit or a reliable source of income, as they reduce the risk for the lender. However, it’s important to carefully consider the terms and conditions of the loan and ensure that you can repay it, as defaulting on a collateral loan can result in the loss of your valuable item.

Pawnshop Loans

Pawnshop loans are loans given by pawnshops. These loans are typically smaller than traditional bank loans and have higher interest rates. However, pawnshop loans can be a good option if you need cash quickly and don’t have good credit.

Pawnshop loans are also a type of collateral loan, where the borrower puts up an item of value as collateral. The pawnshop will assess the value of the item and offer a loan amount based on that value. If the borrower is unable to repay the loan, the pawnshop keeps the collateral and can sell it to recoup its losses.

Pawnshop loans are a popular option for those who need quick cash, but don’t want to go through the hassle of a traditional bank loan. They are also a good option for those with poor credit, as the collateral secures the loan. However, it’s important to carefully consider the interest rates and fees associated with pawnshop loans, as they can be significantly higher than traditional loans.

Secured Loans

A secured loan is a type of loan that requires you to put up something valuable as collateral. If you cannot repay the loan, the lender can seize the collateral. Pawn loans are a type of secured loan.

How to Get a Pawn Loan?

To get a pawn loan, you need to find a reputable pawnshop in your area. You should do some research to find a pawn shop that has a good reputation and fair rates. Once you have found a pawnshop, you need to take your item of value to the shop.

The pawnbroker will assess the value of the item and offer you a loan based on that value. If you accept the loan, you will need to sign a contract and leave the item at the pawnshop until you repay the loan with interest.

If you require quick cash, getting a pawn loan can be a viable option. Here’s a step-by-step guide on how to get a pawn loan:

STEP 1.

Find a reputable pawnshop: Research pawnshops in your area to find one that has a good reputation. Check online reviews and ask for recommendations from friends and family.

STEP 2.

Choose an item to use as collateral: Select an item that has value, such as jewelry, a musical instrument, or electronics. The value of the item will determine how much money you can borrow.

STEP 3.

Get your item appraised: Take your item to the pawnshop to have it appraised. The pawnshop will assess its value and offer a loan amount based on that value.

STEP 4.

Negotiate loan terms: Discuss the loan terms with the pawnshop, including the interest rate, repayment schedule, and fees.

STEP 5.

Accept the loan offer: If you’re happy with the loan offer, accept it and sign the paperwork.

STEP 6.

Repay the loan: Make sure to repay the loan on time to avoid defaulting and potentially losing your item.

- Choose an item with high value to get the most money possible.

- Negotiate the loan terms to get the best deal.

- Make sure you can repay the loan on time to avoid losing your item.

- Be aware of the interest rates and fees associated with pawn loans.

- Consider other options before getting a pawn loan, such as selling unwanted items or borrowing from friends and family.

By following these steps and tips, you can get a pawn loan and use it responsibly to get the cash you need. Remember to carefully consider the terms and conditions of the loan and ensure that you can repay it on time to avoid any negative consequences.

What Happens if You Can’t Repay the Loan?

If you cannot repay the loan, the pawnbroker will keep your item and sell it to recoup the money they lent you. You will not be responsible for any additional debt beyond the value of the item you used as collateral.

Conclusion

Pawn loans can be a great option if you need cash quickly and don’t have good credit. They are a type of secured loan that requires you to put up something valuable as collateral. Pawnshop loans have higher interest rates than traditional bank loans, but they can be a good option if you need cash quickly. If you decide to get a pawn loan, find a reputable pawnshop with fair rates, and read the contract carefully before signing.