What does pawning mean?

Pawning is a way to use an item of value as collateral to secure a loan. Pawnbrokers will usually offer a loan that is a percentage of the item’s value. The loan can be for any amount, but most importantly, it offers a way to get quick cash without having to undergo a credit check.

Most people are familiar with how pawn shops work: you bring in an item, the pawnbroker evaluates it and then offers you a loan. The interest rates on these loans can be high, so it’s important to be sure that you can repay the loan plus interest before you agree to pawn your item.

If you are considering taking your items to a pawn shop, it is important to know what to expect. Here are a few things you can expect when you visit a pawn shop:

1. You will be asked to provide identification.

2. The staff will examine your items and determine their value.

3. You will be offered a loan based on the value of your items.

4. If you accept the loan, you will be required to sign a contract agreeing to repay the loan plus interest within a certain period.

5. If you fail to repay the loan, the pawn shop will keep your items and sell them to recoup their losses.

6. state and federal laws regulate pawn shops, so you can be sure your rights will be protected.

7. You should always shop around at different pawn shops before deciding to ensure that you get the best deal possible.

What do pawn shops buy?

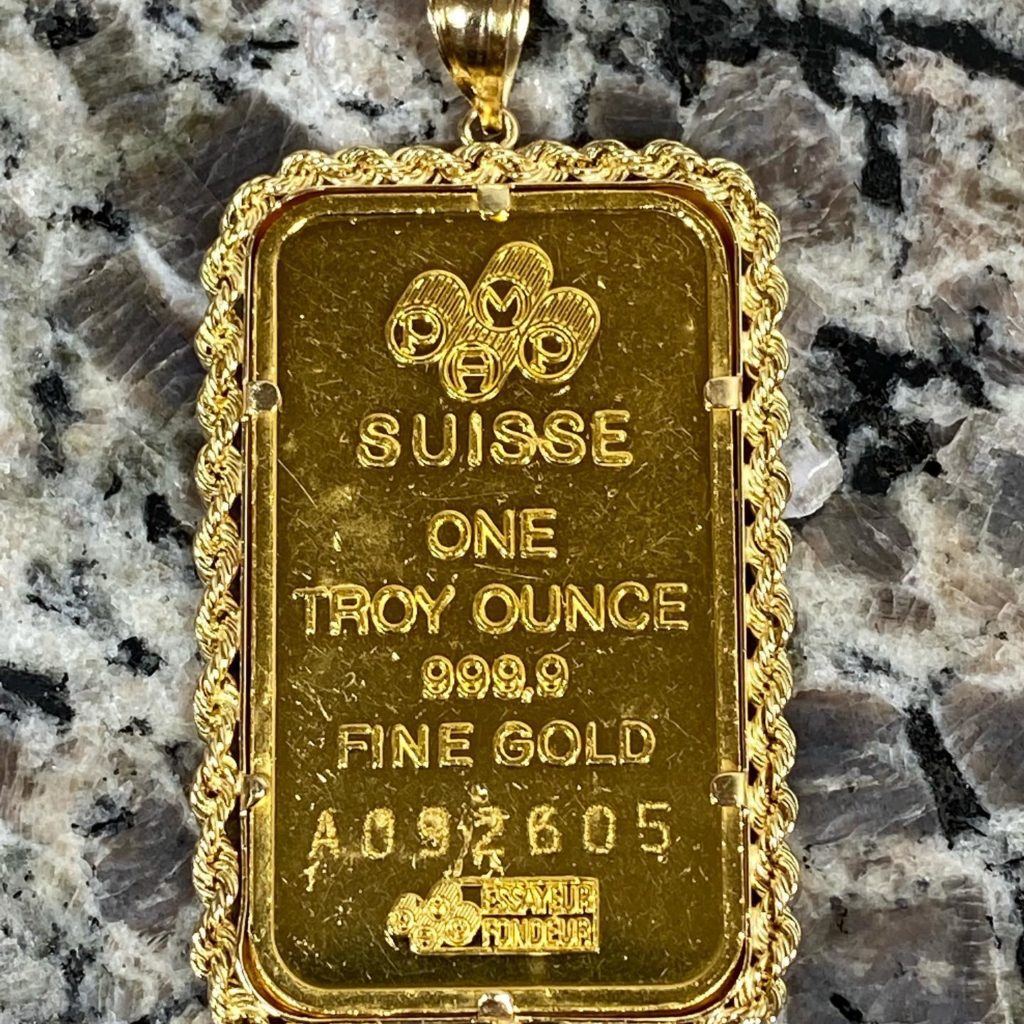

Pawn shops are businesses that buy and sell items of value. They are typically interested in purchasing items that can be easily resold, such as jewelry, luxury handbags, gold, silver, and more. Pawn shops may also offer loans in exchange for collateral, which can be useful for people who need quick cash but do not want to sell their belongings.

When selling items to a pawn shop, it is important to remember that they will only offer a fraction of the item’s worth. This is because they need to make a profit when reselling the item. It is also important to be aware of the risks involved in pawning items, as there is always the possibility that the item will not be returned if the loan is not repaid.

Pawn shops can be a great option for people looking to get quick cash or for those who want to avoid selling their personal belongings. However, it is important to remember that they are businesses, and their primary goal is to make a profit. For this reason, it is important to only pawn items that are truly worth the risk.

What do pawn shops sell?

Pawn shops are in the business of buying and selling used goods. That means they are likely to have a wide variety of items for sale at any given time. If you’re looking for something specific, it’s always worth checking a pawn shop to see if they have what you’re looking for. Here are some of the most common items that you’ll find for sale at a pawn shop:

Jewelry: Pawn shops are well-known for selling jewelry. However, it’s important to remember that not all jewelry is created equal. Pawn shops typically sell lower-quality jewelry at lower prices. If you’re looking for something high-end, you might want to look elsewhere.

Electronics: You can find any electronic device at a pawn shop, from laptops and tablets to smartphones and digital cameras. Of course, because these items are used, they will typically be sold at a discount compared to the retail price.

Musical Instruments: Pianos, guitars, drums – if it makes music, chances are you’ll find it at a pawn shop. As with other types of merchandise, musical instruments sold at pawn shops are usually priced lower than their retail counterparts.

Conclusion:

Pawn shops are a great place to find deals on all sorts of items, from jewelry and firearms to electronics and musical instruments. However, it’s important to keep in mind that not all merchandise is created equal. Pawn shops typically sell lower-quality items at lower prices than you would find at a retail store. With that said, if you’re looking for a bargain on something specific, it’s always worth checking your local pawn shop!